Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

No, the US Economy Is Not a Rigged Game

No, the US Economy Is Not a Rigged Game

Steven N. Kaplan and Joshua Rauh

In a 2014 a16z podcast from the Andreessen Horowitz venture capital firm, economist Larry Summers clearly analyzed the inequality theories of Thomas Piketty, author of the best-selling Capital in the Twenty-First Century. While Summers thinks Piketty’s description of “what” is happening is important, he is skeptical of the “why” of perpetually rising wealth inequality — particularly Piketty’s assertions about rates of return on capital and savings. These are criticisms which many other economists have since offered and expanded upon.

So rather than highlight that bit of the chat, here is Summers on Piketty’s fundamental misunderstanding about how American capitalism works:

His is a theory of accumulation by the fortunate, but what is striking — and you certainly see it out here [in Silicon Valley] in particularly dramatic form is how dynamic the process of wealth accumulation is. Forbes looked in 2012 at its 1982 Forbes 400 and found that less than 10 percent of those who were on the 1982 Forbes 400 were still part of the 2012 Forbes 400.

Now in part [because] 30 years is a long time and people die, and their fortunes get split up several ways. But Mark Zuckerberg had not been born in 1982. So there are all kinds of fortunes being created, and I think a better way to think about the sources of large fortunes is in terms of the economic processes that take all the middlemen out and allow the creator, director, designer to capture a larger part of the benefits.

And that’s what’s behind entrepreneurial fortunes. In a different sense, with much better information systems, much greater capacity to execute, the judgments that a CEO makes as to broad strategy and direction become a larger part of business success than they once were. So entrepreneurial CEOs are rewarded heavily, not just in new companies but in traditional companies. And in a world of this kind of ferment there’s enormous gains to be had by being able to judge the ways in which things are moving and judge who’s doing the best job of taking advantage of the opportunities — and that contributes to the fortunes that are made in the financial sector. So I think it is much better to analyze inequality in terms of the fundamental forces of technology and globalization than in terms of any kind of inherent cultural contradiction of capitalism.

Summers’s intuition and observation is supported by the work of economists Steven Kaplan and Joshua Rauh. In their 2013 paper, “It’s the Market: The Broad-Based Rise in the Return to Top Talent,” they conclude the increase in high-end “inequality has been driven by economic factors that have altered the marginal productivity of certain kinds of labor.” Shorter: The economy is not a rigged game that only benefits those born wealthy or CEOs who manipulate pliant corporate boards.

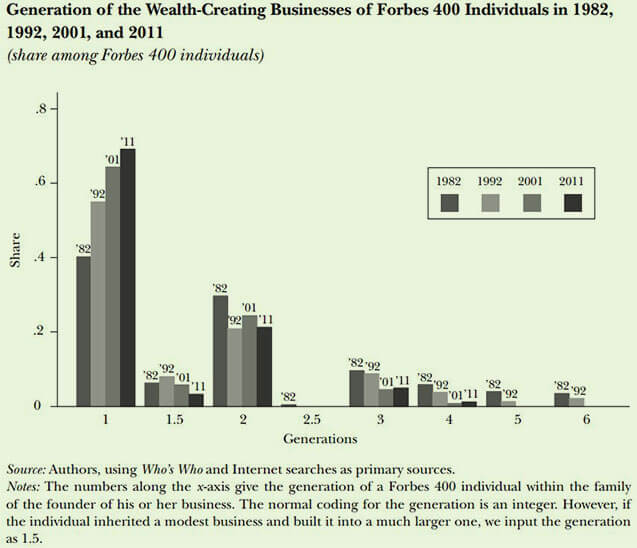

Likewise, their analysis of the Forbes data shows a trend “away from people who grew up wealthy and inherited businesses towards those who grew up with more who grew up wealthy and inherited businesses towards those who grew up with more modest wealth in the family and started their own businesses.” While it is important to note the rich are getting richer, it is equally important to understand why.

Published in Economics

Income and wealth inequality appear to simply be examples of the Pareto principle – in any complex system, roughly 80% of the effects come from 20% of the causes. This has proven to be robust across many different spheres. Pareto himself noticed it when he discovered that 80% of the yield in his pea patch came from 20% of the plants. After noting that, he read an article that showed 80% of the land in Italy was owned by 20% of the people, and realized that there was something interesting going on.

Other examples: In most businesses, 80% of the productivity comes from 20% of the workforce. In software development, 80% of the bugs in a program come from the same 20% of the code. In project management, it’s well known that 80% of the value of the product comes from 20% of the effort. In sales, 80% of revenue comes from 20% of the salesmen. And today, about 82% of global wealth is controlled by 20% of the people.

You cannot prevent this. It’s an intrinsic property that emerges from the iterative interactions in systems where not all is equal. Trying to ‘equalize’ wealth will either result in corruption where wealth is controlled by political power instead of economic value, or you will destroy the productivity of the population. If 80% of your wealth comes from 20% of your population, the last thing you want to do take actions that remove the incentive for the top 20% to be productive.

Or as Robert Heinlein said,

But… But… Bernie’s been telling me that we live in a rigged economy! He says that if he gets elected he can do something. Something!

Agreed: The Economy is not a rigged game.

Access to the economy however is getting more and more rigged. Example: government regulations that increasingly inhibit new, small start-up businesses and do little with regard to larger, established corporations that can withstand the regulatory onslaught. Example: environmental regulations imposing heavy cost on new processes yet grandfather existing processes.

I don’t think the economy is rigged, but entering the economy in any meaningful way has become more difficult as the government has inadvertently increased the barrier to entry. I find it interesting that many conservatives and progressives share the opinion that the marketplace isn’t a fair place to be right now, but diverge so greatly on the reasons as to why and what should be done about it.

I’m curious what the opinion of people here is about what would happen if we deregulated the market at this point. Would the existing companies have too great of an advantage in a suddenly open marketplace? Even if the barriers of entry have been lowered substantially, would the enormous resources of existing corporations be able to butt out and squash new competition? Would an incremental deregulation solve any issues that might arise with this? These are just some thoughts I’ve been having about this, I don’t have too many concrete answers to these question.