Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

November Jobs Report: The “Coke Zero Economy” Continues

November Jobs Report: The “Coke Zero Economy” Continues

The November jobs report was hardly a home run, but it was a hard-hit double into the gap. IHS Global Insight summarizes:

The November jobs report was hardly a home run, but it was a hard-hit double into the gap. IHS Global Insight summarizes:

- For November, the Labor Department’s payroll jobs survey showed a strong increase of 211,000.

- Just as upbeat, the employment gains for September and October were revised up from 137,000 to 145,000 and from 271,000 to 298,000, respectively.

- The three-month average jobs gains were 218,000, compared with the June to August average rise of 207,000 and a year-to-date average of 210,000.

- The unemployment rate held at 5.0%, as both employment (in the Household Survey) and the labor force increased 243,000 and 273,000, respectively.

- The labor force participation rate rose a tick to 62.5%.

- The jobs growth was broad-based, with all sectors (except manufacturing, information services and temporary help) showing improvement—construction and retail were notably strong.

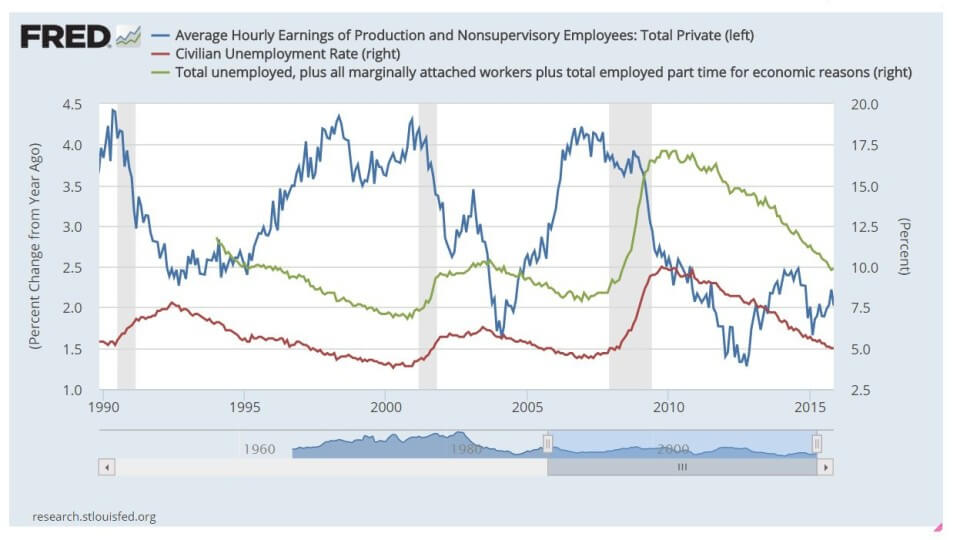

- Average hourly earnings rose 0.2% for a 12-month gain of 2.3%—lower than October’s 2.5%, but above the 2.1% average of June to August.

So the Coke Zero Economy — “If that’s all you have in the fridge, it’s fine, I guess. No, really, it’s fine. Thanks.” — continues.

There are some impressive bits, no doubt. As Capital Economics notes this morning, full-time employment has increased by 10.1 million since 2009, with part-time employment declining by 43,000. And the unemployment rate, now 5%, has been cut in half since the Great Recession peak. And note what Goldman Sachs has to say about the controversial role of declining labor force participation in that drop:

What about the 3.6pp decline in the labor force participation rate since 2007? While it’s true that the unemployment rate would be much higher if participation had remained stable, we now believe most of the decline since that time should be considered structural. By far the largest contribution to the decline in participation has been an increase in retirees—mostly a natural consequence of the aging of the workforce. Rising disability rates—a trend mostly driven by demographics—and a tendency for young people to remain in school have also played a role. The remaining cyclical component is a relatively modest share of the labor force, and broadly captured by the U6 unemployment rate, in our view.

But, but, but … few think this is a booming labor market, not with annual wage growth steady at just over 2% versus the 3-4% seen in strong recoveries and expansions. (Although good enough for the Fed to raise rates apparently.)

And the broader U-6 unemployment/underemployment rate of 9.9% is still above its medium-term low of 7.9% in December 2006, the last pre-Great Recession year. Also, the current labor force participation and employment rates are hardly optimal, ceteris paribus.

Although some economists think the US economy is at heightened risk of recession, the consensus is same-old, same-old for 2016. Slower job growth, but better wage growth.

How will voters see things? Clearly even a mild recession would be quite bad for the Democratic presidential nominee. But maybe the economy will be good enough to grind lower the still-terrible right track/wrong track number which still stands at over 60%. Even so, deep anxiety will likely remain about the economic future in an age of fierce global competition and automation. A big electoral bonus to candidates who can persuasively speak to that.

Published in Economics

Hard hit double?!?!? Hardly likely. We created 3,000 full-time jobs. Just 3,000.

Look at Full-Time Employment. Go to the user friendly St Louis Fed FRED we site and look for dara series LNS12500000

You will see that November added a whopping 3,000 full time jobs.

November number was 122,027,000 full time employed.

October was 122,024,000. We gained 3,000 full time jobs.

Janet Yellen pointed out that we need 100,000 new jobs a month to absorb the new entrants. I wonder what the other 97,000 new entrants are doing?

Working part-time. At 2 jobs.

The problem with this analogy is that Coke Zero is delicious. This economy is more like generic soda.

The other piece not mentioned here are the types of jobs created. If we created 500,000 ditch-digging jobs each month, would that be great news? Maybe if each gig paid six figures and came with a golden shovel.

Zero Hedge has a quick breakdown of the numbers, not in great detail (I’d have to crack open more data to look at all of it), but still: These are not numbers you want to see.

I would suggest the rise in retirees is also caused by what happened to my sister. She was laid off at 62 y.o. She “took retirement.”

Rising disability rates have increased because the administration is allowing more people onto disability. They have expanded the definition of what is a disability. This makes the unemployment rate look better and they know it.

Young people are remaining in school because they can’t get jobs if they leave. Duh!

Goldman Sachs analysts are shilling for the administration.

@Pilli: I agree with you about your sisters situation. I have a friend this is happening too in the last few months and he is at 60. I know a few others in simulator situations that just got tired of looking for jobs not there and retired before 60, most figure a way onto some sort disability.