Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

Oxi-Notes on the Morning in Europe

Oxi-Notes on the Morning in Europe

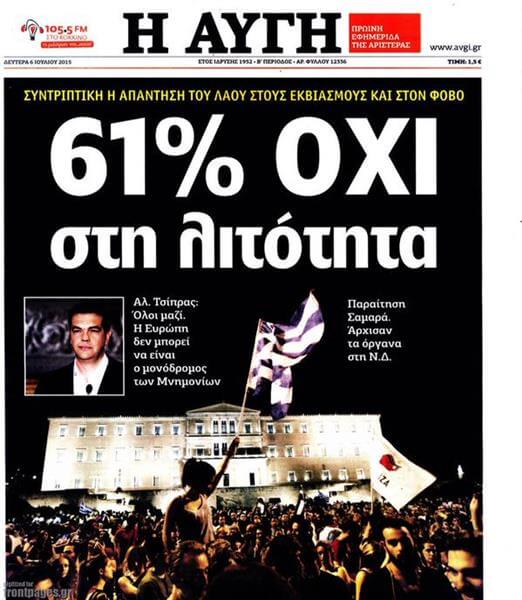

1) Headline writers throughout Europe have been manfully resisting all variants on the obvious Oxi-moron joke. This is perhaps because everyone on Twitter came up with it first. (I measured this.)

1) Headline writers throughout Europe have been manfully resisting all variants on the obvious Oxi-moron joke. This is perhaps because everyone on Twitter came up with it first. (I measured this.)

2) Game theorists are frantically trying to discern the strategy behind Greek Finance Minister Yanis Varoufakis’s abrupt resignation. Has he been inspired by Nash Equilibria or by Nash Schizophrenia? As yet unclear.

3) At least the result of the vote was overwhelming. I say “at least” because one of my fears was a vote so close as to make accusations of fraud and vote-rigging credible. So that’s a good thing, at least.

4) European leaders are now in an “emergency summit” here in Paris. (It seems to me silly to keep calling these “emergency” summits. Surely we need to keep some terminology in reserve? I haven’t yet ventured out to gather man-on-the-street reactions, but I predict that when I do, I’ll see nothing that looks like an emergency. I do expect to hear nonstop griping about the way traffic has again been brought to a crawl by the daily emergency summit.)

Update: It seems I’m not the only one to think this. According to The New York Times, French Finance Minister Michel Sapin has downgraded it to a “deep conversation.”

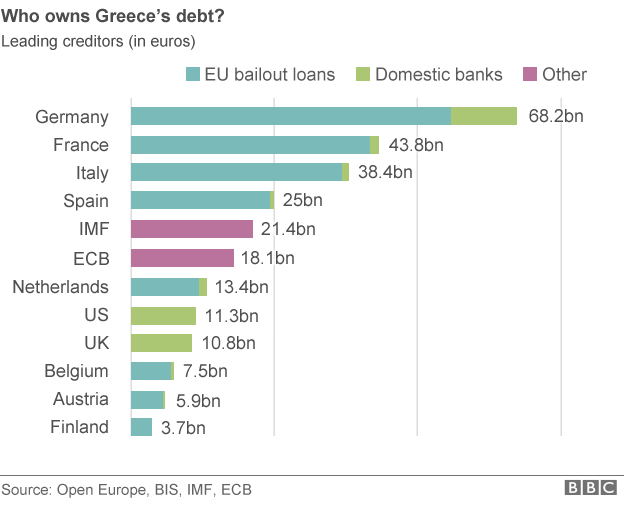

5) I’m puzzled by the prominence of locutions such as this in the media: “The risk of fallout from Greece’s collapse directly hurting other European countries is relatively small. Most of its debt is held by governments who could cope with default.” Does anyone who writes such a thing ever ask himself where, exactly, governments obtain the resources to “cope?” Could I be the only one who suspects taxpayers might somehow be involved?

4) The vice-president of the European Commission for the Euro, Valdis Dombrovskis, is offering reassurances: “We have all the necessary tools to assure the financial stability of the euro zone … it’s clear we’re capable of defending” the single currency, he insisted, even if the results of the referendum “obviously complicate things.” With every word he uttered, investors reacted with more of what The New York Times mutedly calls “muted dismay.”

5) France and Germany don’t seem to be of the same mind about what the outcome of the referendum means. “The basis of a dialogue is on the table, but it’s up to Greece to show us that it takes the dialogue seriously and that it knows it can stay in the euro and that there are decisions to make,” said French Finance Minister Michel Sapin.

Le Monde reports that President François Hollande told Tspiras that he was ready to help him. “But you’ve got to help me help you.”

A majority of European states already want to throw Greece out of the Euro, and even if France doesn’t wish this to happen, it can’t for long stand up to them if Athens fails to demonstrate signs of good political and budgetary will. “Tspiras must absolutely show that he’s ready to deal,” said a confidential government source.

(Perhaps Varoufakis’s resignation was meant to be a sign that Tsipras is ready to deal?)

Germany? Not so emollient. Government spokesman Steffen Seibert put it thus: “Conditions to start negotiations on a new aid program are not met yet.” The Greeks, he said, had voted against the principle that solidarity requires countries to take responsibility. (I note that even in print he speaks with a noticeable German accent. The whole subject-verb-object thing just defeats him.)

Deputy Chancellor Sigmar Gabriel likewise said that renewed negotiations with Greece were “difficult to imagine.” Tsipras had “torn down the bridges” between Greece and Europe. A debt cut for Greece, said a finance ministry spokesman, “is not on the agenda for us.”

Dutch Finance Minister Jeroen Dijsselbloem found the referendum result “very regrettable for the future of Greece,” but Italian Foreign Minister Paolo Gentiloni wasn’t so dismayed. “Now it is right to start trying for an agreement again.” On the other hand, he added, “there is no escape from the Greek labyrinth with a Europe that’s weak and isn’t growing.” (A Greek labyrinth, get it?) But Italy, he said, “has always worked for a solid and more integrated Europe. It was true yesterday and it will still be true tomorrow.”

The ECB’s Ewald Nowotny, who’s also president of the National Bank of Austria, seemed to be on the “firmly regrettable” side. Any new Greek deal would take time, he said. Expecting an agreement within two days, as Greece has hopefully proposed, is “illusionary.” (I suspect that’s a mistranslation of “delusional,” but I’m not sure.)

Ah, cheer up! The upbeat Spanish Economy Minister Luis de Guindos just weighed in. His government, he says, is ready to talk about a third Greek bailout. “Everyone wants Greece to stay in the euro,” he declared, leaving it unclear who “everyone” was. But “the rules for the euro remain the same as they were two days ago,” leaving it unclear what those rules were.

And of course there’s Cyprus. “Cyprus will stand with Greece to achieve a loan restructuring that will make its debt sustainable,” President Nicos Anastasiades assured his European countrymen. “The first thing is the absolute respect for the decision of the Greek people, not only from us, but also from all Europeans and in particular from all the European governments.” He too seems to be using the word “all” in a highly limited sense, perhaps as a synonym for, “That’s what I think, anyway.” Cyprus’s finance minister, Harris Georgiades, assured Europe that his bailed-out country would leap to the rescue to write off its rescue loans to Greece — if Germany went first, of course.

Spot any patterns here?

In Oxi-short, Henry Kissinger would still be at a loss if asked what number he should dial to reach Europe. (The journalist in me does wonder what would happen if I dialed this one. I’m awfully tempted. I’ll ask them if they keep Prince Albert in a can.)

Published in Economics, Foreign Policy, General, History

Dissolve the EU.

(As I wrote in the Member Feed thread:)

I think Tsipras has it right. Europe is there to be milked, and Greece reckons they can do it forever.

One of Churchill’s finest moments was when, in 1939, he refused to allow German emissaries to address Parliament and offer settlement terms. Churchill understood that to even listen was to open the door to doubt and inaction – and would probably have led to Germany winning the war. But it is a very hard argument to make: we are not even prepared to hear what they have to say.

It is all a superb reductio ad absurdum: take bureaucrats who never turn down the opportunity to have conferences and meetings and discussions, and put them in a position where, in order to lose, they merely have to be unable to say “no more” to further meetings and discussions.

I cannot imagine the EU reaching that conclusion. And so the saga will keep spinning.

Dial 867-5309

That chart is interesting. While I knew Germany was the principle loaner, I had not realized how much France and Italy and even Spain had put in. Those are sizable amounts, especially Italy’s and Spain’s given the size of their economies and their debts. I’m not an economist, so i have no opinion on what the EU should do, but I have never seen the logic of the EU. Why not just have free trade agreements and let their individual currencies float to each country’s advantage? Well, if Greece defaults, there are going to be some angry Europeans.

Step 1: Borrow a bunch of money and promise stuff to people.

Step 2: ?

Step 3: Prosperity!

Can they please get this over with? Everyone knows, but won’t say, that this ends one of two ways. . . .default (call it a haircut or whatever euphemism you want, if you don’t pay a bond as agreed it is a default) or drachma/devalue.

That is when it gets interesting. If Greece defaults, who is next in line asking for the same (Italy/Spain/Portugal)? If they go the drachma/devalue route and the sun still rises the next day in Athens without being on the Euro, what is the next currency to return (lira/peseta/escudo)?

Clearly the answer is to worsen, deepen and postpone the collapse and make sure its a lot bigger when it happens. Bad governance in Greece and the EU should be expressly rewarded at the expense of taxpayers and to the detriment of all Europe and possibly the entire world.

And when it is time for a deal this bad, there is only one guy to call: John Kerry.

Wonder what “You’ve Got a Friend” sounds like in Greek?

They can hold meetings all they like, but right now the ECB decides whether Greece’s bank machines will start working again. This is nothing like scientific, but I suspect public sentiment in the rest of the EU countries is leaning toward, “Well then, get your own bank machines to work, then.” Varoufakis did Greece no favors by calling the creditor nations “terrorists.” At this point, the French seem torn between their impulse to tell the Greeks where to shove it and their even-more instinctive impulse to tell the Germans where to shove it.

As for Churchill, he had many fine moments, but is also known for saying it’s “better to jaw-jaw than to war-war.” It would emphatically be better for a great many politicians in Europe to step off the crazy ledge: These countries are all going to be sharing the same continent, forever. This mess will have to be unraveled, but it’s best done slowly and carefully. I never approved of this marriage in the first place, but a quickie divorce in Vegas isn’t a responsible solution to a bad marriage.

Oooh! Oooh! I know. Italy can repossess Corfu. Germany can get Rhodes and Kos in exchange for its share of Greek debt. Spain will take Zakinthos.

France? How about Thira?

Seawriter

Am I the only one who thinks Varoufakis looks like Lord Voldemort?

Don’t be mean. Lord Voldemort does not deserve that.

Seawriter

No you are not.

You’re not even the only one asking if you’re the only one, as you can see.

Claire,

With all do respect to the Parthenon and its creditors there appears to be a much larger story on the Horizon. Much much larger.

CHINA’S FAILING STOCK MARKET RESCUE FACES ‘BLACK TUESDAY’

Atlas Shlugged?

Regards,

Jim

I agree.

Remember the trash compactor scene in Star Wars?

I think that auctioning off Greece sounds like a great idea.

I got a bad feeling about this.

One things for sure we’re all going to be a lot thinner.

Regards,

Jim

The risk of fallout from Greece’s collapse directly hurting other European countries is relatively small. Most of its debt is held by governments who could cope with default.” Does anyone who writes such a thing ever ask himself where, exactly, governments obtain the resources to “cope?” Could I be the only one who suspects taxpayers might somehow be involved?

Translation “We’ve managed to shift costs to tax payers from the powerful who made the decisions and who will complain bitterly and effectively if they are made to live with the risks they created.” They have more credibility and can face default with the conviction that no really important people will suffer a great loss, just citizens.

They’ll shout at each other until August/September and then Greece will exit the Euro. These sorts of things usually happen in August/September. The predictable timing helps the finance crowd make more money from every cataclysm.

Y’all have got it all wrong. The banks forced Greece to take on all that debt!

Open your eyes, sheeple!!!

Source: http://www.nationofchange.org/2015/07/05/greece-what-you-are-not-being-told-by-the-media/

I’m reminded of a furniture store in town that’s been “Going Out of Business” for the last 5 years. At least they have something to sell.

It’s not false advertising if they eventually do go out of business.

I still don’t get why anyone bought Greek bonds. I can understand how various brokers and underwriters would want to move the bonds, get their money and be done. I don’t understand why anyone bought them. I think I might rather bring my last cow to the fair in search of the guy with the magic beans or let my email buddy with the connections to the Nigerian Minister of Finance have access to my bank account.

When the Greeks last managed their own currency, what was the annual inflation rate? 10%? Inflation: a feature not a bug of the drachma! Inflation was the time-honored way of screwing bondholders. Less drama. What possessed the Greeks to think they could function fiscally like Germans and surrender the right to debase the currency?

The printing press.

We’re constantly told that government economics isn’t the same thing as household economics. And people… Greeks included…. are starting to believe it, because we see that when households don’t pay their debts, they’re in a world of *insert scatological euphemism here*, but governments can just whip up new money. “Deficits don’t matter”, as a former vice-president once said. And he’s apparently right. There’s nothing backing the world’s currencies except the say-so of the world’s governments. We’re all playing this huge game of pretend, where governments, banks, and investors all play along as if there’s real value in those electrons and pieces of paper.

The Greeks may be corrupt and have a snotty sense of entitlement, but they’re also just calling the government/financial world’s bluff. “Why can’t you print more for us? You do it for yourselves”. The US racks up debt, and prints money at near zero interest rates. And yet… no collapse. Greeks are probably going “Why can’t we do this too?”

The simple answer is that in July 2012, Mario Draghi said, “the ECB is ready to do whatever it takes to preserve the euro, and believe me, it will be enough.” He announced, in other words, that Greece was too big to fail. The IMF compounded the error by repeatedly screwing up their forecasts, either through incompetence or wishful thinking.

Partly historical baggage. European politicians saw regional economic integration as the means to tame nationalism and reduce the likelihood of another war in the continent after the two world wars.

The drive toward a common market was always there from the beginning of the European project. They started with coal and steel, the resources essential to war-making, and wanted to subject production and trade in those goods to supranational authority.

One of the goals was to promote rebuilding and growth through internal European trade. Although a free trade area (FTA) would eliminate tariffs and barriers among the participating Europeans, each country would maintain its own tariff policies with respect to countries outside the FTA. In doing so, however, non-member countries could simply sell their goods to the FTA member with the lowest tariffs and then take advantage of the absence of tariffs within the larger European market to sell to the rest, thereby undermining the goal of intra-European trade creation. They opted instead for a customs union whereby all member countries maintained a common tariff policy vis-a-vis non-members.

The single currency is a related, but distinct topic. Having one eliminates transaction costs and makes it easier to do business across borders. The best example of this? The US dollar used across 50 states.

Wait, are you talking about negotiations with Greece or with Iran?

Keep in mind the root of this fiasco:

Greece basically forged its books to gain admittance to the Euro. Then, when the financial crisis came and everyone’s accounts were under scrutiny it became clear that Greece’s debt load was already bad. But to stay in the Euro they borrowed even more and more again. Talk about throwing good money after bad.

This appears to be a new “Oxi Day”.

The old one was October 28th 1940 in response to an ultimatum from Mussolini.

If I recall correctly, the Oxi was accompanied by a hand signal referred to as a “fig”; with a meaning similar to the middle finger in english speaking cultures.

Thanks.