Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

Do Enterprise Zones Really Work to Lift Inner Cities?

Do Enterprise Zones Really Work to Lift Inner Cities?

“Enterprise zones” have an intuitive appeal. Flood a poor area with all sorts of aid to attract business. Create thriving little Hong Kongs in places of despair, particularly urban areas, through the miracle of free enterprise. Some folks, especially on the right, have suggested turning Detroit in a giant, low-tax enterprise zone. And President Obama has proposed his own version, “promise zones.” More from the San Francisco Fed:

Federal Empowerment Zones consist of relatively poor, high-unemployment Census tracts. They offer businesses tax credits of up to $3,000 per worker for hiring zone residents and (in the original zones) block grants of up to $100 million to be used for business assistance, infrastructure investment, and training programs. Benefits vary across state programs, but many also emphasize hiring credits.

But do these enterprise zones actually work? I have been trying to assemble an urban policy agenda. But I don’t find these results especially compelling. Again, the SF Fed:

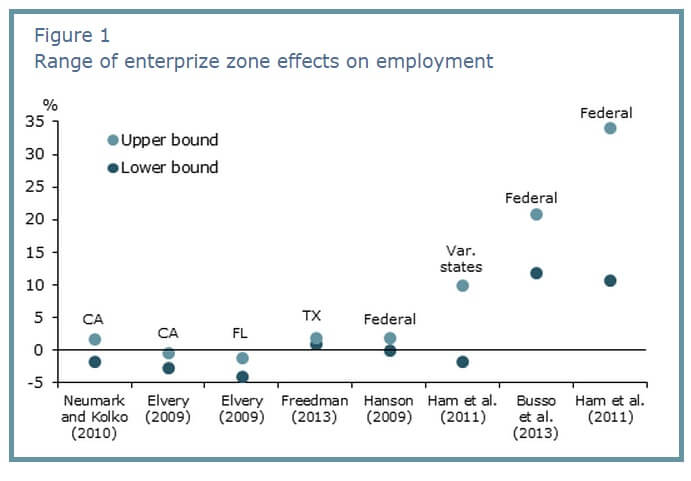

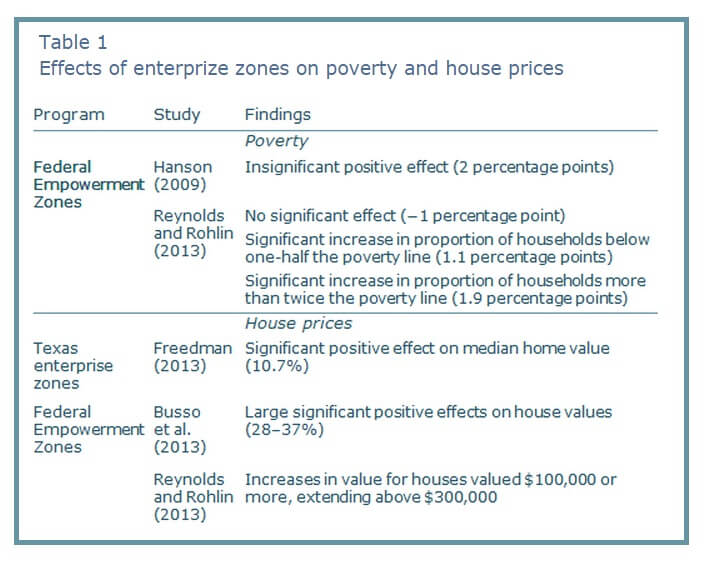

First, even though some research on federal Empowerment Zones finds some evidence of positive employment effects, other research fails to find evidence of reduced poverty, and points to some increases in the share of households falling below other low income thresholds. Second, there is consistent evidence of housing price increases, implying that benefits are received by unintended recipients. Other results not included in the table sometimes point to negative spillover effects on nearby areas, suggesting that enterprise zones largely rearrange the location of jobs rather than creating more of them.

Our overall view of the evidence is that state enterprise zone programs have generally not been effective at creating jobs. The jury is still out on federal programs—Empowerment Zones in particular—and we need more research to understand what features of enterprise zones help spur job creation. Moreover, even if there is job creation, it is hard to make the case that enterprise zones have furthered distributional goals of reducing poverty in the zones, and it is likely that they have generated benefits for real estate owners, who are not the intended beneficiaries.

I sat for a tenure on the Urban Enterprise Zone in Asbury Park, New Jersey.

The way the program worked was simple: Businesses in the zone would charge half the state sales tax (so 3.5% instead of 7%), the goal there being to attract customers.

The tax collected would not go to the State coffers, instead coming under control of our local board.

We had some discretion on how to spend the money back on the business community. Much of it was spent on façade programs, and in that regard the program was successful as we spruced up the appearance of a lot of buildings that had been blighted for decades.

Some of the spending I thought frivolous – like helping entrepreneurs pay for presentation materials to bring to banks to help them get a loan. It was pretty obvious many were pie in the sky dreamers who couldn’t get a loan shark to believe in them let alone a bank.

As for the overall success of the program, Asbury Park has gone from urban blight back to its thriving heyday as a tourist destination (just the east side near the ocean), but the UEZ wasn’t the only thing going on. Lots of effort from lots of directions brought the City back. The UEZ was one of those positive pressures.

If you are ever in the area look me up. I’ll give you a tour of how this City that was so blighted people were giving away real estate (that’s not an exaggeration) to a hotbed of urban renewal.

Then we’ll drink and catch Bruce Springsteen at the Stone Pony, because that helped fight the urban blight too!

Why does Texas need enterprise zones? The whole state is an enterprise zone. Tax credits and block grants cost the Treasury money and breed crony capitalism in the form insider information. The politicians are the first to learn of and possibly direct the location of zones and particular projects. You can bet that friends and family just happen to invest in the path of these projects and some of that money turns into campaign contributions.

It would be much more efficient to lower employment taxes, or, better yet, institute a broad, low flat tax with no employment taxes, tax credits, or social-engineering grants. If you want a mini Hong Kong, you have to do what Hong Kong did. Institute a 10% flat tax, repeal all other taxes and most regulations, and stand back. This is the king of enterprise zone free market economists like Milton Friedman had in mind, not the crony capitalism we got.

Why are there “poor areas”? Do you honestly think the root causes are economic? Why then would anyone think the solution is an economic one?

Nothing to add, but keep them coming, Mr. P. I’m always interested in what you write.

To what extent is the problem that the enterprise zones aren’t radical enough? If you could really make an area where the free market could really do its thing, rather than nibbling around the edges of our massive tax and regulatory burden, does anyone think that business would not grow dramatically in those areas?

And how much is this the equivalent of keeping Granny on the respirator? People used to move to follow or find employment. Instead of spending millions to keep the people in place and bring the jobs, why not spend thousands to move the people to where the jobs are? Let the dead cities die. Long live the new cities.

Targeting tax breaks and subsidies to particular groups of people doesn’t work?

But without those “policy tools”, what are “reform conservatives” left with?

How will they “support the middle class”, if giving tax-breaks and subsidies will only lead to reallocation of resources, rather than increasing the size of the pie?

Big problem here, which, of course, won’t stop AEI or some other “reform conservative” policy think tank form suggesting the same programs again to help the “middle class”.

These sort of “policies” are doing what they’re supposed to be doing. Reallocation of resources. I.e., buying votes.

There is such a condition in economics where the free market has abandoned an area, based upon the length of time and gravity of the blight.

There were 2 times before the Kelo v The City of New London decision where the Supreme Court allowed eminent domain to benefit a private developer, and one of those instances involved an area that the market had abandoned (breaking up the Hawaiian oligarchy was the other one).

When the market simply won’t involve itself in an area, then extra-market efforts become the only hope.

I lived through this. Asbury Park was so bad people were literally giving away real estate just not to have to pay the taxes anymore. No new construction for decades. Homes were so devalued they were being purchased at closing with a credit card. This condition lasted for over 30 years.

I’m a market guy, but when the market says for decades (we aren’t coming) then other measures are allowed.

It can work. A building in Asbury Park that was on the market for free in the mid-1990s sold in the early 2000’s for $50,000, sold about 2 years after that for $500,000 and 2 years after that for $1.5 million.

A building I passed on in 1997 for $150,000 sold 5 years later for $2.6 million. I was a tenant in the building at the time. Wanted to shoot myself.

All of this was after some very fancy urban renewal efforts, outside of free market forces, were employed.

Please do a whole post (or series of posts) on this Asbury Park thing (I know nothing about Asbury Park – don’t think I’ve ever heard of it before this comment thread). It’s fascinating, and I can’t find anything about it over at city journal (5 articles, but none about its transformation over time).

responding the quoted bits above:

1) was it unsafe? If people keep getting robbed and getting their businesses torched, I can imagine they might give up on the city.

2) “outside of free market forces” – does this mean government programs? does this mean cronyism?

Basic trade theory known in the 17th will tell you why these zones fail: you cannot bridge a large productivity gap with externally financed investment, the only effect is that inflation will rise and you might get a lot of bad investment.

The classical policy mix is to build local human and physical capital stocks, through a combination of a positive personal savings rate and improvements in education.