Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

Was Not Helping Underwater Homeowners a Massive Mistake?

Was Not Helping Underwater Homeowners a Massive Mistake?

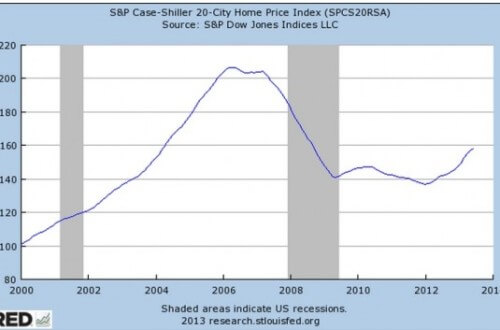

In their much-praised new book, House of Debt, economists Atif Mian and Amir Sufi argue the 2000s housing crash caused a much worse recession than the tech-stock crash because asset losses were more heavily concentrated among the 99% — who then stopped spending. The burst Internet stock bubble, on the other hand, “concentrated losses on the rich, but the rich had almost no debt and didn’t need to cut back their spending.”

In their much-praised new book, House of Debt, economists Atif Mian and Amir Sufi argue the 2000s housing crash caused a much worse recession than the tech-stock crash because asset losses were more heavily concentrated among the 99% — who then stopped spending. The burst Internet stock bubble, on the other hand, “concentrated losses on the rich, but the rich had almost no debt and didn’t need to cut back their spending.”

Which raises the following counterfactual: what if Washington had pushed massive relief for underwater homeowners?

Former Obama Treasury Secretary Timothy Geithner doesn’t think something like a principal reduction scheme would have helped much. As he wrote in his new book, Stress Test: “We did not believe, though we looked at this question over and over, that a much larger program focused directly on housing could have a material impact on the broader economy.”

Mian and Sufi disagree. Their research suggests $700 billion in principal forgiveness of underwater mortgage debt in 2009 would have produced a $126 billion spending boost. And that is just the direct economic impact. In addition, write-downs “would also have had the indirect positive effect of drastically reducing foreclosures and the associated negative effects of foreclosures on the economy.”

Along the same lines, Columbia University economists Glenn Hubbard and Christopher Mayer cooked up a mass refinancing plan a few years back where homeowners with a GSE mortgage could have refinanced their mortgage with a new mortgage at low rates. This could have helped as many as 30 million borrowers save $75 billion to $80 billion a year for the duration of their mortgage; in effect, a long-term tax cut.

And there was this proposal from economist Martin Feldstein: “To halt the fall in house prices, the government should reduce mortgage principal when it exceeds 110 percent of the home value. About 11 million of the nearly 15 million homes that are “underwater” are in this category. If everyone eligible participated, the one-time cost would be under $350 billion.”

But the Geithner “save the banks, save the economy” view, as Mian and Sufi put it, won over President Obama and the day. Mian and Sufi: “The fact that Secretary Geithner and the Obama Administration did not push for debt write-downs more aggressively remains the biggest policy mistake of the Great Recession.”

Back to the counterfactual: imagine a plan like the ones Feldstein, Hubbard, and Mayer proposed, along with a Fed that was far more active in supporting spending starting in 2008. And now imagine no TARP and no stimulus. Under which scenario does the economy perform better?

Published in General

Perhaps we would have just been better off if the government had utilized the Resolution Trust Corporation to purchase or take possession of troubled, government-backed assets and told the banks that the Fed would underwrite their orderly entry into bankruptcy in exchange for breaking those financial institutions up into investment and commercial components and reinstating Glass-Steagal.

This would have had the effect of removing much of the panic, writing down the bad debts and stopping the “too big to fail” problem.

When the large banks had a liquidity crisis (their unstable financial situation was put under stress) the government gave them a lifeline and an orderly method to unwind their liabilities. They did this even though banks had taken reckless action to get into such a financial situation. This reinforced the US overinvestment in the unproductive parts of the financial sector.

We could have used schemes to give homeowners a lifeline and ease their exit from unsustainable mortgages. However this would have had a cost and a drain on our economy just like TARP. We would have reinforced moral hazard and we would have reinforced overinvestment in real estate. It would become an asset that the government would implicitly backstop if all hell broke loose.

Maybe we should have done TARP and a homeowner bailout even with the risks and downsides. How can we know the consequences of doing nothing wouldn’t be even worse?

I’m inclined to think a better way would have been to let the government take all the troubled mortgages off the banks books and allow homeowners to convert their mortgages to rent until the homes could be sold and the government could recoup its investment.

I have always been unhostile to TARP in that the mortgage problem had a healthy dose of government culpability, and in light of the huge amounts of money lost, I think we should be thankful that we (people who elect the people who made the stupid decisions), got off lightly by lending money that was mostly paid back.

Helping homeowners in the first place was a mistake. Doubling down on a losing bet is never a good idea. So your counterfactual would have just made things worse in the long run, as it would have embedded the gov’t even further in the housing market, encouraging people to take on even more debt that they couldn’t support.

Do I read you right, if we gave homeowners $700 billion free and clear, they would help us out by spending $126 billion?

I guess I don’t see how that is such a bargain. We spent close to a trillion in stimulus and that didn’t do much, you want to add another $700 billion to that with the same result.

It seems to me real problem is that our economy depended too much on people spending their house equity like it was income. Principal forgiveness would send them the message that was the right thing to do.

I had the same reaction. I’m sure there’s some economic axiom or theory they can pull out to support the case, but I find it difficult to believe that the “indirect positive effect” would approach $574 billion anytime soon. Even then, even if that effect is achieved, the overall net effect remains at zero because that initial $700 billion had to come from somewhere to begin with.

Equity that was, in many cases, overvalued to begin with.

If an individual has too much debt and can’t pay it off, one of the legal remedies is declaring bankruptcy. There’s some pain in that. There should be, moral hazard and all that.

Let me say this: Once the money has changed hands in a mortgage transaction and is spent on something else… it’s gone. The issue I have here is that mortgage principal is nothing more than an accounting entry in a ledger at a bank. The revenue which banks derive from payments on mortgages reduce the amount in the ledger and generate operating revenue for the bank. The whole system is premised upon somebody’s promise to repay. When that promise is broken the system breaks down.

Now, given the choice between foreclosing on a delinquent loan or taking a write-down on an accounting ledger the rational banker should have taken the write-down offered mortgage restructuring – this would have made their balance sheets look worse in the short-run but it might have offered some relief to people who might not have defaulted which in turn would have improved the cash-flow of the banks and might have taken them out of the realm where they needed to be bailed out at all.