Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

Do Liberals Really Think An 80% Tax Rate Wouldn’t Hurt the U.S. Economy? — James Pethokoukis

Do Liberals Really Think An 80% Tax Rate Wouldn’t Hurt the U.S. Economy? — James Pethokoukis

Federal income taxes went up last year, a financial reality becoming ever clearer to many higher-earning Americans as tax day looms. But how much higher can Washington clip wealthier Americans before rising tax rates really weigh on US economic growth?

Quite a bit, some would argue. Despite those tax hikes, the American economy actually grew faster in 2013 than in 2012. Real GDP — measured fourth quarter over fourth quarter — accelerated to 2.6% from 2.0%. Another point: while the current top tax rate of 39.6% is the highest since the 1990s, the economy has done just fine with top rates double that level. Real GDP grew by 3.6% annually in the 1950s even with a 91% top rate. Going forward, progressive economist and inequality researcher Thomas Piketty recommends a top rate of 80% in his new book Capital in the Twenty-First Century, a work much praised on the left. Clearly, then, tax rates could go a lot higher both to reduce income inequality and raise more dough for government spending programs, right?

Quite a bit, some would argue. Despite those tax hikes, the American economy actually grew faster in 2013 than in 2012. Real GDP — measured fourth quarter over fourth quarter — accelerated to 2.6% from 2.0%. Another point: while the current top tax rate of 39.6% is the highest since the 1990s, the economy has done just fine with top rates double that level. Real GDP grew by 3.6% annually in the 1950s even with a 91% top rate. Going forward, progressive economist and inequality researcher Thomas Piketty recommends a top rate of 80% in his new book Capital in the Twenty-First Century, a work much praised on the left. Clearly, then, tax rates could go a lot higher both to reduce income inequality and raise more dough for government spending programs, right?

Actually, it’s far from clear that we’re not already at Peak Tax, or at least near the summit. First, fiscal austerity last year was offset by monetary stimulus as the Federal Reserve embarked upon its bond-buying program.

Second, the top effective tax rate in the 1950s was closer to 50% because of tax loopholes in an economy experiencing some amazing one-off, postwar tailwinds. High-tax advocates like Piketty want to raise rates and get rid of loopholes, creating sky-high effective rates never before experienced in an advanced economy.

Third, high rates in states like California and New York mean “we might be pretty close to the revenue-maximizing tax rate,” Alan Auerbach, a center-left tax economist at the University of California, Berkeley, told the Wall Street Journal.

Fourth, estimates that sharply raising tax rates has little to no impact on taxpayer behavior completely ignore possible longer-term effects. What about all those folks who take risks and make career choices in hopes of striking it rich? “Significantly reducing that possibility by hitting those individuals with extremely high income taxes is of first-order importance in determining the optimal top tax rate,” AEI’s Aparna Mathur, Sita Slavov, and Michael Strain argued in a paper last year.

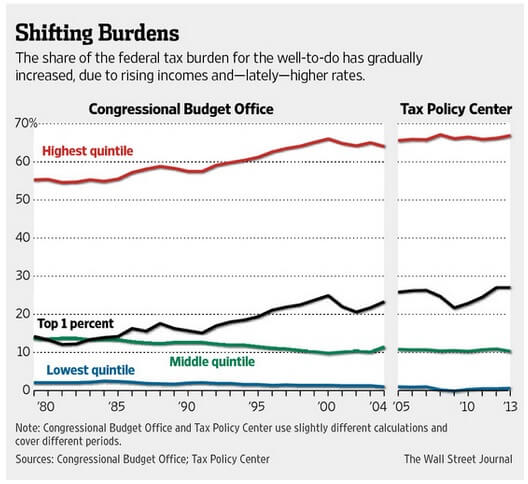

Fifth, it’s not the just the 1% bearing a large share of the income tax burden. Citing the CBO, the WSJ notes that “the increase in the individual income tax burden borne by the top 20%—such as couples with two children making more than $150,000—has gone from 65% in 1980 to more than 90% as of 2010.”

Given an aging society, the US in the future will need to collect more revenue than the postwar average of 17.4% of GDP. How much? Maybe at least a quarter more, and even that’s assuming smart entitlement reform. To do that without crippling growth, the US will need to shift from a progressive income tax to a progressive consumption tax. The US tax burden may be headed higher, but top income tax rates shouldn’t be.

Published in General

Do they believe higher tax rates won’t hurt the economy? As absolutely as a Medieval alchemist believed lead can be transformed into gold. Are they right?

Well, here is my story.

Back in 2011 two friends and I contemplated taking the severance money we were getting as the Shuttle program ended and sinking it into a business. After examining the economic tea leaves (including Obamacare and potential future tax hikes) we shelved our plans as too big a risk for too little reward.

The three of us found salaried positions with remuneration at or above our previous jobs. However, the 5 others we planned to hire remained unemployed for a year or longer, and found jobs at pay much lower than what we planned to pay them. Plus, there were three others who lost jobs that I and my would-be partners took instead of starting our own company.

Those eight jobs were never created, so they were never lost, and did not count as a detrimental effect of bad government policies. Confirmation bias for the liberal alchemists who believe higher taxes do not “destroy” jobs. And part of the reason for minimal job growth.

Seawriter

Yes. They do indeed believe this.

One of my pub trivia team-mates was yammering about how people simply don’t need that much money, and that the Reagan tax cuts caused the US debt to skyrocket.

They really, really do believe this stuff.

The point about 80% rates or even 100% rates is that the libs have no intention of paying them. These rates are about punishing their opponents, power and graft. Rates at that level require anybody wanting to live or thrive to come to the political table and hand over money for politicians to carve out and defend tax exceptions for selected groups. Those that do not come to the political throne with bowed head and bended knee will cease to exist.

Where you see jobs that never got created, libs see the workers you did not exploit. From their point of view they stopped a great evil.

What I would like to know is why they think it’s an ethical point of view. They just assume it is, without ever questioning their own assumptions. Robin Hood is way out of date. I wish he’d go away.

I don’t think the title of your post has a “yes” or “no” answer. My viewpoint is that they don’t really care, as long as they think it’s “fair”.

My response to this is: If someone told you that, for the work you do, the Government will confiscate 80% of your earnings above a certain level, WOULD YOU DO THAT WORK? Hell,no!

Perhaps, instead of “income inequality”, we should be thinking about “motivational inequality”.

Of course, there are sloths at the top and go-getters at the bottom. There are also folks who are impaired by unfortunate circumstances beyond their control. But there are also cultural pathologies, from Appalachia to Watts, that are enabled by government assistance programs. We all know that this situation can cause multi-generational dependence.

We ought to spend more time considering the pitfalls of taking money away from high-earners and giving it to able-bodied people who are content to maintain a comfortable, if somewhat deprived, existence while doing nothing. Does such a policy serve those people well?

We all know the answer to that question by considering an analogue at the familial level. Is it better to feed your unemployed, basement-dwelling twentysomething a steady diet of fast food and video games, or kick him out on his arse?

No doubt. But I suspect the five people we would have hired (we all worked at the same company) would have appreciated our exploiting them rather than ending up on unemployment followed by work in retail stores once unemployment ran out. Only one has a job comparable to the one they had in 2011 and that had lower pay and worse benefits than their old job.

Seawriter

That is why they (the libs) have to stop you. To them companies and entrepreneurs are evil, and the workers they exploit are just too innocent and unsophisticated to know what is good for them. True the libs may destroy the world and starve some people but they are building a better future for all and some collateral damage is to be expected. Besides less people on the planet is a good thing.

There is lots to eat while we are eating our seed corn.

“..fiscal austerity last year was offset by monetary stimulus…” Whaaaat? Where was this fiscal austerity of which you speak?

I’m very pleased to offer counter-anecdotes. The two moderate liberals with whom I discuss politics have both made comments at different times indicating the basic concept of the Laffer Curve has sunk into a wide swath of the mainstream. I.e., that there really is such a thing as a marginal tax rate high enough to sink the economy, and–best of all–that Reagan faced just that situation in 1980.

But neither is a full blown, romantic, Left-Wing-Thought-Is-My-Religion lefty.

Yes they do believe it, but they should know better.

I remember watching Chris Hayes (don’t ask why). He and some random guest were discussing cigarettes. They were gloating about how cigarette smoking rates have dropped significantly. And they were attributing that to cigarette taxes. So, they understand conceptually that when you tax something you get less of it.

Maybe they do actually believe in American exceptionalism. No matter how much we raise the taxes we’re so exceptional it can’t hurt us.

I think the “average” “liberal” doesn’t think a very high tax rate will hurt the economy, but mostly because I don’t think the average liberal thinks far enough ahead to see consequences like Seawriter’s experience. Once they think about it

In my more cynical moments, I think for the “elite” “liberal” (politicians) a hurt economy is a design feature, not a bug. A booming economy makes it much harder to exert political control.

I’ve been pondering a Member Feed post about this, but Robin Hood’s characterization of “stealing from the rich and giving to the poor” doesn’t have the same meaning now as it did in feudal times. The short version is that “steal from the government and give to the taxpayers” is more accurate.

Part of me is starting to suspect that we’re dealing with a Gandhi mentality. Gandhi was so convinced that free market capitalism was inherently immoral that he thought it better for the Indian people to suffer than to compromise their (his) morals.

I really do worry sometimes that the hard left actually knows we’re right factually, but they don’t care. Capitalism is pure evil and must be opposed, even if that means people suffer.

But it should, since “the rich” were all aristocrats who got that way thanks to taxes and unearned direct benefits from the state.

Robin Hood stole from an illegitimate king and his cronies, and redistributed that wealth back to the commoners who had rightfully earned it through their hard work.

France just raised their tax rate to 75% about a year ago did they not? How is that working out for them, apart from enticing some of their wealthiest citizens to obtain citizenship in places like Belgium and Monaco?