Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

Why Are Working-Class Americans Paying For Your Student Loan “Forgiveness?”

Why Are Working-Class Americans Paying For Your Student Loan “Forgiveness?”

Everyone has a story. And if you’re one of the millions of Americans who eschewed a college education for other vocations – homebuilding, plumbing, truck driving, or a host of manufacturing and service jobs – I bet you have a story, too. Or worked to pay off your debt. Perhaps with a little help from family or “angels.”

Now would be a good time to tell your story.

Maybe you’re the parent of children (hand raised) who graduated from college but saved or earned enough to cover the rapidly-rising tuition rates and made sure they didn’t graduate with debt. You knew that would burden the start of their career.

Or maybe you hustled for scholarships while taking two or three jobs each semester (or trimester), from washing dishes in the campus cafeteria before 8 a.m. classes or selling women’s shoes at the local clothing store on weekends (hand raised, again). Also, serving as a resident advisor in the college dorm to cut room and board costs. Sometimes, a former boss of a Braum’s Ice Cream store in nearby Norman, where I worked during high school, was short-staffed on a busy weekend night and asked for help. The extra income came in handy, and the work kept me out of trouble on weekends (mostly).

Perhaps you chose a school like the University of Science and Arts of Oklahoma instead of a more expensive institution. In the 1970s, this small public liberal arts college in Chickasha would let you attend the third-trimester tuition-free if you were a full-time in-state student for the first two trimesters. That cut my tuition costs by a third since I was working my own way through school sans parental assistance (neither of my parents at the time had earned a college degree). And I graduated early; my college career nearly spanned Gerald Ford’s presidency.

Resourcefulness is a wonderful skill to learn early in life. And you don’t need a degree from a fancy university to succeed, however you define or measure it.

The thought of applying for a student loan was unimaginable to me in the 1970s. It was way more imaginable for my two sons in the 2000s, although we didn’t qualify for low-interest or government-backed loans or student aid (we checked). Success doesn’t go unpunished. Private student loan rates in the late 2000s were over 8 percent annually. And while both our boys attended top-notch private liberal arts colleges, their graduating with debt was abhorrent to every instinct in my body. Our retirement savings took a hit, but we never hesitated to invest in our sons’ future.

“I’m wearing my $250,000 college golf shirt,” I’ll still tease my boys. That joke hasn’t aged well and invokes predictable eye rolls. We have no regrets. Even though whatever remained of any loans they might have taken out might be “forgiven.”

I also know that many of my 27 fellow 1974 graduates from Oklahoma’s rural Washington High School in McClain County didn’t graduate from four-year colleges. That’s true of many high schools, by the way. All work hard, many with their hands. They raised wonderful families and inculcated the next generation with their values.

Yet, some $300 billion to as much as $980 billion in US taxpayer money is about to be spent over 10 years to forgive $10,000 in student loans to graduates of tony universities, including graduate, medical and law schools for individuals making $125-150,000 per year or less (that’s nice income), or an estimated $300,000 for couples (broadly defined, I’m sure, so long as they file joint tax returns). It might be illegal. It is certainly immoral and unfair.

Most beneficiaries will be the wealthiest. From Bloomberg News:

Forgiving student loan debt will cost between $300 billion and $980 billion over 10 years, according to a new analysis, with the majority of relief going toward borrowers in the top 60% of earners. Most Americans rightly fear it will add to inflation, their top concern.

The Penn Wharton Budget Model estimate was released Tuesday ahead of President Joe Biden’s long-anticipated decision as soon as this week on whether to forgive some student loan debt. White House officials have been trying to combat critiques that such a move would add to rampant inflation that’s become a political liability for Biden and his fellow Democrats.

The Penn Wharton budget group, based out of the University of Pennsylvania and run by a top former Treasury official under Republican President George W. Bush, is influential with key Capitol Hill lawmakers, including Democratic Senator Joe Manchin.

The group estimated that between 69% and 73% of any debt forgiven would accrue to households that rank in the top 60% of the US’s income distribution.

But for many, Biden’s forgiveness plan doesn’t go far enough, including the NAACP. TheBlaze tells the story following a newly-inaugurated Joe Biden appearing before a CNN town hall less than a month into his presidency. “Classist and racist,” some say:

Socialists and others on the left excoriated President Joe Biden over his admission that he didn’t have the power to forgive student debt for those who owed up to $50,000.

The president voiced his unpopular stance Tuesday evening during a town hall event on CNN when a young woman asked him when he would forgive more than the $10,000 he had previously suggested.

“I will not make that happen,” Biden responded.

“It depends on the idea that, I say to a community, I’m going to forgive the debt of billions of dollars … for people who have gone to Harvard and Yale and Penn,” he explained.

Biden had other plans to extend debt relief to some Americans according to different criteria, but many on the left angrily denounced him for not supporting a blanket relief for all student debt up to $50,000.

“[I]t’s extremely classist and racist to assume that only rich people can get into ‘elite’ schools,” said one user.

There’s no question that student loan debt is a huge burden to tens of millions of graduates, many of them well into their 30s and 40s, even their 50s. US Senator Marco Rubio (R-FL) didn’t pay off his college student loan debt until he published his autobiography in 2012 (but did not ask anyone to forgive it). A credible case can be made that the system is a mess, including predatory lending practices. And there are better solutions. National Review:

Two recent papers from the Manhattan Institute nicely illustrate conservative ways of approaching these issues. And each touts an idea with some support in Congress.

The first, written by Jason Delisle and released today, makes the case for “income-share agreements.” Under these arrangements, a lender pays for a student’s education, and in return the student pays a set percentage of his income for a set number of years. This way, students pay for their education during the years when they’re benefiting from it the most — the years when their earnings are high — and are protected against big bills when they’re struggling.

Delisle’s proposal is to take this as a model for the entire student-loan program. The rule is simple: You can borrow up to $50,000, and for every $10,000 you borrow, you owe 1 percent of your earnings for the next 25 years (unless you first hit the repayment cap of 1.75 times the amount of the loan). If you get married, you pay for your ISA based on half the household income. If you make less than $12,000 or receive the earned-income tax credit, your payments are reduced or eliminated.

Everyone is entitled to nearly twice as much money as the typical four-year student borrows today, and no one ever loses more than 5 percent of his income repaying it. Further, collections are handled through the existing income-tax system, streamlining the process.

Senator Rubio has re-introduced 2019 legislation, the LOAN Act – supported by the United Negro College Fund’s President but ignored by Democrats – to address the student loan crisis:

“Working-class Americans should be able to pursue an education without having to worry about finding themselves trapped in an insurmountable debt cycle for years beyond graduation,” Rubio said. “My bill would reform our federal student loan system so that borrowers don’t get stuck with debt they can never repay. Instead of accruing interest, borrowers will pay a one-time fee paid out over the life of the loan and will be automatically placed in an income-based repayment plan. It’s time to update our federal student loan system, because fear of debt should never stand in the way of an education and the pursuit of a better life.”

“UNCF has been a long champion of reforming our financial aid system, and we have been vocal in advocating for reducing the burden on students to repay their loans,” President and CEO of UNCF (United Negro College Fund, Inc.) Dr. Michael L. Lomax, said. “I am excited to support a bill that would not only eliminate interest rates on student loans, but create a process that increases equity in our financial aid system and takes unforeseen financial circumstances that would affect a borrower’s ability to repay their loan, regardless of income, into consideration. This is a strong and robust proposal, and low-income students would fair better under the repayment system this bill creates versus our current structure. It is my hope that this bill will spur further conversation and proposals around innovative ways to reform our federal financial aid system that benefits our low-income students.”

US Senator Josh Hawley (R-MO) has an interesting idea – to make colleges pay the loans of students who default. Given that some universities have eye-popping 11-figure endowments, it makes you wonder how that extravagance can be used to help solve this crisis instead of picking the pockets of working-class Americans and forcing their children to incur more federal debt.

It’s a fairness issue. And it isn’t fair to most working Americans who didn’t incur student loan debt or paid it off to subsidize “forgiveness” of loans they were not forced to take. National Review editor Charles C.W. Cooke has a take that most Americans will associate with (emphasis added):

Proponents talk of “canceling” student debt, as if the debt would magically vanish at the stroke of President Biden’s pen. But the debt cannot just vanish, because it has already been issued and it has already been spent. When advocates suggest that the debt should be “canceled,” what they mean is that responsibility for paying it should be transferred — at the point of a gun — from the people who borrowed and spent the money to people who did not. Those who owe federal student debt owe it because they chose first to borrow it, and then to spend it on a service that they duly received. Those who do not owe federal student debt do not owe it because they did not choose to borrow it, they did not spend it, and they received no services in exchange for it. To use the word “cancellation” in this context is no different from using the word “cancellation” in the context of my mortgage. A few years ago, I borrowed some money to buy a house, which I have since owned and lived in. That debt cannot disappear; it can only be pushed onto someone else — be that my mortgage company, other mortgage payers, or taxpayers in general. If that were to happen while I remained under my roof, it would be a scandal.

Let’s call it for what it is. Welfare.

Democratic peddling of student loan debt stories – all of which will feature “diverse” people – has already started and will intensify over the next couple of months, leading to the November 8 election. Never mind what colleges are indoctrinating teaching your children these days.

“Thank you, Joe Biden,” many will say as they run to Starbucks for their daily lattes or to pick up another bottle of wine at Trader Joe’s after their latest pilates session. They are thanking the wrong people. They should thank – and apologize to – the waitresses, truck drivers, nurses, nursery operators, and others who didn’t incur student loan debt but are now forced to subsidize yours.

Working class Americans are not entirely unsympathetic, even though they’ve suffered the most economically from the pandemic. While they didn’t get a degree, some of their children incurred debt and are among the 41 percent of college graduates in 2020 who were in jobs that don’t require a degree. That debt is helping drag down our economy, although inflation – Bidenflation – has more sway.

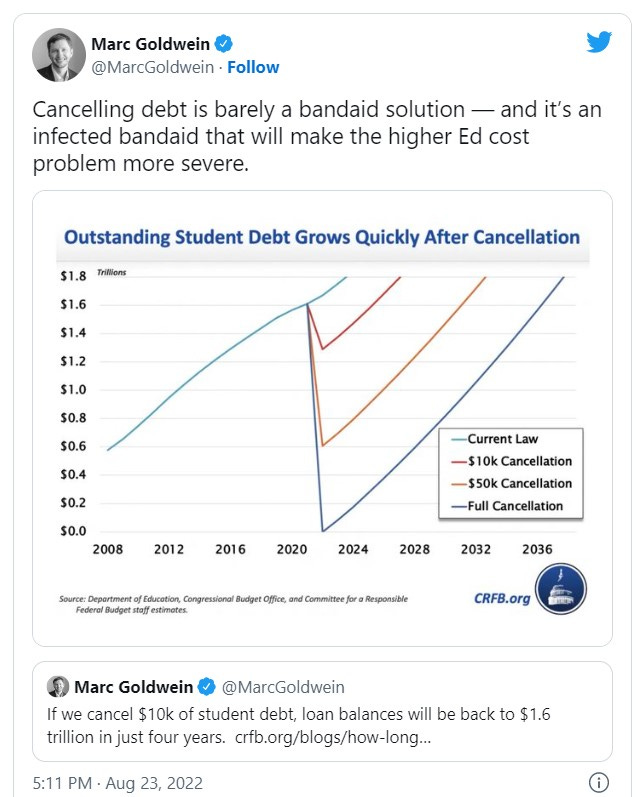

Too many colleges and universities have bloated budgets and tuitions that worsen the problem without enough accountability. And the more the government throws at higher education, the higher tuition costs go.

There are better solutions. It is now time for working-class Americans to drop the handle on those welfare wagons, tell their own stories, and vote accordingly on November 8th. Demand accountability.

Published in General

Why are Working-Class Americans Paying For Your Student Loan Forgiveness?

It is a very good question, for Ricocheteers who believe that the proper role of government is to properly

For the other Ricocheteer (or are there others beside me?) a morally legitimate question is, “Why are ANY Americans (who are NOT members of classes with pre-defined privileges and punishments) paying for your student loan forgiveness? Why is even the luckiest, richest American paying for it?

< devil’s advocate mode = on >

If, as many on the right have been arguing recently, a university education is no longer worth the expense, and if the reason tuition has risen so much faster than inflation is because of the education policies of the federal government, then wouldn’t the combination of those two points be justification for the federal government forgiving the loans (as long as the federal education also eliminated the policies that caused the problem in the first place, so future students wouldn’t need to take out crippling student loans)?

After all, if it’s the feds that put these people in debt for a worthless degree, then wouldn’t “forgiveness” really be restitution?

< devil’s advocate mode = off >

These are big “ifs”, but they are the “ifs” to which many on the right subscribe.

Here’s the problem. Those on the right don’t have any way of knowing what a given good is worth to someone else. Nor do those in the middle, nor or those on the left.

No-one on this supposedly all-inclusive spectrum of opinions about what any goods are worth to some other human being have any idea what they are talking about, nor any right to impose their opinions.

In fact, all men were created equal, with an equal right to decide their own economic values, so the role of government cannot be to impose its own choices.

When we overthrew “the right” side of the spectrum (King George and the hereditary ruling classes), we actually overthrew the spectrum itself. It is the proper role of government to protect individual rights, not to substitute its favored judgements of class rights and class guilt.

Is the fish responsible for biting the lure? No one forced students to purchase an education they can’t afford.

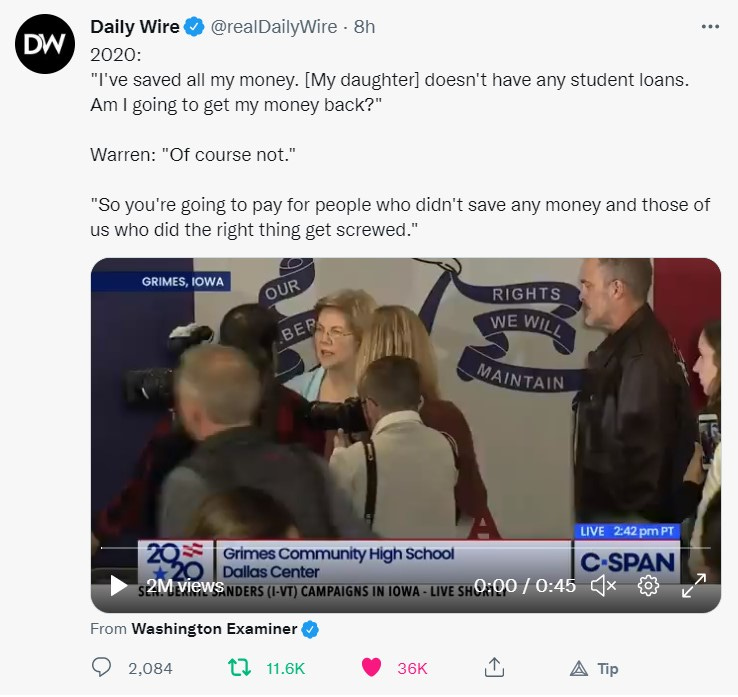

The problem seems to remain, what about the people who already paid off some or all of their loans?

From a pragmatic level, as a conservative I would be willing to accept student loan “forgiveness” if it was couple with some other legislation.

This point has the same problem as the credits for solar panels etc: it doesn’t work unless someone has federal tax liability. I guess one could argue that someone who gets a degree that doesn’t produce income sufficient to have a federal tax liability, was just a sucker. But that might make it harder to pass such a bill.

Why not make it a refundable credit for the entire amount of loans/interest, which can be taken all at once, or divided out over a selected number of years?

Oh, and probably the amount of payback is NOT considered taxable income in those future years!

That particular part I put under a couple of requirements on purpose. First, the credit only applies to those who have paid off their student loans before the legislation is enforced (going back to 1980 to be sure and cover most of the crazy education inflation) as a way to reward responsible people who pay taxes (have tax liability) that paid off their loans before this windfall. Second, making it tied to actual tax liability instead of a refund draws a distinction between people who accumulated debt getting degrees that then lead to real jobs that accumulate tax liability and those who racked up debt by extending their college experience getting degrees that don’t accumulate tax liability like gender theory and Master’s in underwater basket weaving. This allows Doctors, advanced engineers etc.. to take advantage of it but likely not those who got a Master’s in Feminist Theory.

But it could still be refundable all at once, so someone could put that money into their business etc.

I’ll grant that I’ve had a pretty physical work day so I’ve applied a bit of bourbon to ease a few aches and pains; if you make it refundable for anyone who’s got college debt (instead of those who accumulated tax liability) how do you limit it to people who didn’t just hang out in an extended high school, get a useless degree, and rack up a crap ton of debt? I’ll confess I’m a little fuzzy so I may be missing something huge here (sorry if I am).

Well how about if they’ve already had X years of tax liability, they can apply it retroactively, not just apply it to FUTURE years of tax liability?

So, adjusted returns ( I don’t know how far back you can go…)

At least to start with. Of course, whatever the limit might be now, could be extended for this program.

Normally, the limit for filing amended returns, and for audits, is 3 years. But the IRS can go back 6 years if they want to, so make it 6 years, at least.

Because conservatives neglected this issue like every other. We could have had endless hearings and hauled university presidents before the country to explain administrative bloat. We could have showcased the commie crap theyre pumping young people with. Our enemies could have been made to answer for the indentured setvitude they are putting young people into for a crap product. We could have made them pay for it. We could have won young people over by showing them what enemies these social justice freaks are to their mental and financial well being. Conservatives at a minimum could have cut the governments role out of college loans. There was never an attempt or even the pretense of an attempt. Now we have a class of people who got defrauded and it is only growing. And the reason we will pay as a country is because the default conservative position is to do nothing and whine about the left when they take action on an issue that was sceded to them.

Nor for pursuing degrees in subjects where no one would pay them for what they were taught. Certifications that demonstrate an interest in accumulations of opinions, and not knowledge, should not be subsidized by taxpayers.

I think the problem is that it’s not a problem of tax logistics: it’s a bad principle that should not be pursued.

If these things are true, student loan forgiveness should REQUIRE education reform.

Even while I’m in favor of student debt forgiveness, I won’t support it without fixing the underlying issues. That just perpetuates and entrenches the problems that got us here.

Well, we know that education is worthless. How do we know? Because so many people aren’t willing to actually pay for it.

Rather, they are willing to have the good if someone else pays for it, either through dischargeable student loans (before the bankruptcy ban), holding out for future forgiveness or simply defaulting, scholarship, or employer funded.

So we know already the vast majority of education is not considered worth it.

I don’t disagree that it’s a bad principle, but I would be willing to accept it if was the trade off to reform the system, and honestly the last requirement should be that the reforms have to have been implemented before the loan forgiveness. I say this is someone who has already paid off their loans and sacrificed quite a bit to do so. This is all theoretical anyway. The left is going to do it if they feel they can get away with it regardless and I’m 99% sure they wouldn’t sign on to any reforms even if it meant getting what they wanted.

Sure, why not pay it off. They are going to do it anyway one way or another. Anything to feed more Democrat mouths.

Because America is no longer a Republic. We’ve become an oligarchy, a tyranny of a few. The classics teach that oligarchy is one of the outcomes of unconstrained democracy. Outside of a Republic, the people in charge always become wealthy at the expense of those they rule.

In 2006 I dropped out of college. I wasn’t willing to go into debt to get a crappy education and be taught by professors who knew less about my field of study (computer graphics) than I did. Most CG engineers and pretty much all artists in the U.S. are educated by some combination of de facto apprenticeships and self-education.

After the 2008 financial crisis I found myself dealing with the rather intense labor market discrimination degree holding workers put in place to protect their own hides. Do you know what it’s like to make it past the technical interview for a job only to be told HR vetoed your hiring? That happened three or four times.

The Constitution bans patents of nobility. It’s time to defund higher education.

I don’t know if we could have convinced them of that, if the bottom line reality was that they weren’t going to get hired without the expensive degree. “We” weren’t in control of that.

Many places were just requiring a degree to be hired, it didn’t matter what the degree was for.

Overall, I agree. But if there is going to be “student loan forgiveness” it better apply to those who already paid off their loans.

This is an interesting conversation. Former-President 0bama was a lawyer, but his real wealth sprung from his life-long commitment to community organizing and social activism, a specialty that he was raised into by family and friends.

And now-multimillionaire Patrice Cullors has a MFA, but her path to wealth was essentially high school apprenticeships in community organizing. She claims to be a “trained Marxist” activist.

As a teenager Cullors joined the Bus Riders Union (BRU), during which time she attended a year-long organizing program led by the Labor Community Strategy Center (which organized the BRU). She learned about revolutionaries, critical theory and social movements from around the world, while practicing activism which amounted to on-the-job training. Cullors also enrolled at Grover Cleveland High School and was admitted into its social justice magnet program.

It would seem that her university successes were not the stepping stone to financial success that Marxist training and apprenticeship in activism were.

How about members of corporate media confront life long academics like Liz Warren about why the cost of a higher education cost so much to begin with.

More norms and inflation

I wonder if they are all going to kick 10% to the big guy

However, they would likely not have been given entrée without the fancy credential(s).

It was like this before the 2008 crisis. Companies have substituted a 4-year degree for tests of ability, since those were effectively banned after Griggs v. Duke Power (1971).

Yes, 0bama actually worked as a lawyer, reportedly forcing banks to create under-collateralized home mortgages, so he did work as a lawyer, or rely on his law degree at least.

But creating BLM? Do you really think Cullors’ MFA was responsible in any way for her access to activist circles and her success? She didn’t tout it. She touted her Marxist training.