Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

Economic Illiteracy on Parade

Economic Illiteracy on Parade

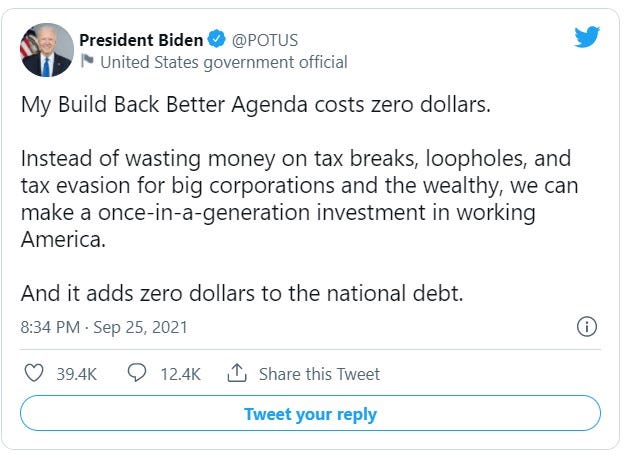

The new Democratic talking point about their $3.5 trillion budget “reconciliation” is that it “costs zero dollars.” You read that correctly. From our avatar president’s Twitter feed:

The last line tells us how Democrats define “costs zero dollars.” It “adds zero dollars to the national debt.”

First, they don’t know that. The Congressional Budget Office (CBO) hasn’t scored anything yet because no one knows what the actual bill looks like. It is the subject of a big fight between Democratic “liberals” (some erroneously call them “moderates”) and the Democratic left (some call them “progressives”). And you are unlikely to see their score until after the bill is enacted, at least in the House.

But suggesting that government spending especially on this scale somehow costs zero dollars is like saying a rental house costs zero dollars because renters pay enough rent to cover the owner’s mortgage. The owner may have an even cash flow on his or her property, but someone is paying. And that pesky mortgage! And God forbid you need to repair something, like a roof, or more.

Which, in the case of the $3.5 trillion “Build Back Better” budget act, means you pay. Businesses that pay these taxes pass them off to their consumers in the form of higher prices. Taxes are a cost of doing business. But we’re now getting ahead of ourselves. More about this later.

But here’s what that $3.5 trillion hosing of money into our economy really means, especially on top of some $5 trillion from the previous “stimulus” bill, and not including the $1.1 trillion bipartisan infrastructure bill:

Economic law #1: When too many dollars chase too few goods, inflation happens.

Inflation is already up to an annualized rate of 5.3%, the highest it has been since the Reagan administration. “The Squad” and its 30 or so followers in the House “progressive caucus” don’t think $3.5 trillion is enough, by the way. They wanted $6 trillion. That was their starting point, and they’re kinda done negotiating. They feel somewhat empowered by years of the Federal Reserve Board spending tens of trillions — money out of thin air — to buy bonds. It has kept interest rates remarkably low.

Inflation erodes the value of your savings. It erodes the value of your paycheck. You pay more for goods and services. Just ask the people of Venezuela.

According to economist (and personal friend) Brian Wesbury of First Trust Portfolios in Chicago, Modern Monetary Theory is apparently the Democrat’s governing economic principle, which is neither new nor has proven successful.

Some think that Modern Monetary Theory (MMT) allows the Fed to print money to finance this debt with no consequences. This is delusional, and we agree with Mervyn King, the former head of the Bank of England who says MMT is neither modern, monetary, or a theory. It’s been tried before, by the Romans, the Weimar Republic, Zimbabwe, Venezuela…all with disastrous results.

Satire site Babylon Bee further demonstrates the absurdity of the “costs zero dollars” claim.

Quedando had originally told her husband she would be spending $3.5 trillion at Target on prairie dresses, shoes, Magnolia decor, “a few things for the kids,” groceries, knick-knacks, throw pillows, and candles, among other “small” purchases. When this proposal didn’t poll well among her husband base, she quickly released a statement that the $3.5 trillion in spending would “actually cost $0 when you think about it.”

According to Quedando, when you look at how many coupons she used, the deals she got, and the fact that she put everything on her Target credit card, the total cost of her massive purchase was actually “a wash.”

“Honey, think about it this way,” she said as she got home with 50,000,000 truckloads of stuff from Target. “If we didn’t buy this stuff, we wouldn’t have saved all that money by scanning every item in the Target app. Then we would have saved $0. This purchase actually ends up being an even trade off.”

At publishing time, Quedando had claimed they’d actually made money on the purchase, since American dollars are depreciating so rapidly that all the home decor she bought would actually retain value better, and her husband had to admit she had a point.

The fictional Ms. Quedando could be a Democratic member of Congress, even Squad worthy.

Oh sure, President Biden claims that no one who makes under $400,000 a year will pay any new taxes. And only the wealthy will pay the taxes necessary to cover this spending over an estimated 10 years. Reminder: The spending happens faster than the tax revenue, especially as an election nears.

But we do not yet know what taxes will ultimately be included. Democrats want to raise the top marginal rate to nearly 40%, along with corporate income taxes back up to 29%. But other taxes may be in the offing that you’re surely going to pay for, ultimately, including talk of a $15 per ton carbon tax on oil and gas producers. The prices you’re paying at the pump today, already 30% higher than when Biden took office, will look like the good old days in a few short months if enacted. “But you’ll get rebates,” Democrats will claim, so long as you buy electric cars and whatnot. Don’t believe them.

It probably won’t pass because Sen. Joe Manchin, the Democrat from coal-producing West Virginia, is against the idea.

Another exposition of economic illiteracy comes from White House Press Secretary Jen Psaki, who posits:

Economic law #2: Businesses do not pay taxes, which are a cost of doing business that is priced into their goods and services. In other words, you pay the cost for higher taxes in the form of higher prices.

Economic law #3: The wealthy pay a much lower percentage of their “income” in taxes because a) they invest their money to grow it and protect it from taxes, and b) they hire or can access smart financial advisers who show the way.

These two laws are related because they deal with the same issue — how businesses and business owners and investors — especially the wealthy. They have the ability, as tech investor Peter Thiel did, to put billions into “tax-free” IRA accounts, or park millions more into “donor-advised funds” to get upfront charitable tax deductions not yet made but “parked” for the future.

It’s also a fact that we pay taxes on our income, but not our “wealth.” And that makes sense. You actually use and spend your income; your wealth hopefully grows. But until you use your wealth, it can grow (or not) without tax consequences. That seems fair.

Far-left senators like Elizabeth Warren and Bernie Sanders (who is the author of the $3.5 trillion spending plan) want to tax wealth AND income. If you open the door to taxing wealth on top of income, it becomes double taxation. While the wealthy may be first in line, if you own your own home or have saved and invested well over a career, you will eventually look wealthy to Sens. Warren and Sanders, along with their friends in The Squad.

Economic law #4: The more you tax something, the less you get of it.

But here’s the deal. One of the reasons companies like Amazon don’t pay much in taxes is that they reinvest in their business. Those investments are tax deductible: things like people, new warehouses, etc. You know, things that create jobs.

Raising taxes on investments will result in less investment, fewer jobs, and slower growth.

None of this is rocket science. Those of us who are on “Team Reality” know all this instinctively. Yet our government elders live in an alternate universe. You know, like where a $3.5 trillion spending bill — more than we spent to fight World War II — costs zero dollars.

When you next vote, whether in Virginia or elsewhere, send them a message. Vote Team Reality. Do NOT vote for a Democrat.

Published in General

I think the main issue, and the main illiteracy, is that claiming (falsely, really) that “it doesn’t add to the debt” is NOT the same as “it doesn’t cost anything.”

I don’t even believe the current iteration of (D) is economically illiterate.

The (D) Party is being run by hard Leftists and if the economy falters and/or breaks then that is just the latest “crisis” they are looking for in order to further solidify their control.

So what if the citizens are poorer and the economy is garbage, the (D) will be their to “help” ….. themselves.

Yes, that’s right. Taxes aren’t a part of the cost of production. Producers should pay for increased taxes out of the same unlimited source of cash they already use to pay the current taxes. /sarc

Borrowed from a different thread, but fits perfectly here. Doink!