Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

Yes, Falling Prices Can Be a Bad Thing — A Very Bad Thing

Yes, Falling Prices Can Be a Bad Thing — A Very Bad Thing

When the possibility of deflation is dismissed or even welcomed, it reminds me of a “Curb Your Enthusiasm” episode. If I recall the plot more or less correctly, Larry David was trying to join a Republican country club for some reason. Anyway, while pretending to be a stereotypical GOP rich guy — the rich part was easy since David in real life is worth nearly a billion dollars — he made the following dismissive remark about global warming, “People like it a little warmer, don’t they?”

Hey, people like lower prices right? What’s wrong with a little deflation? I, for one, love paying less for a better flat screen TV. And wasn’t there deflation during the booming late 19th century? The thing is, though, there is good deflation and bad deflation. A helpful primer from The Economist:

A short spell of deflation driven by cheaper oil would in some circumstances be a tolerable thing. Indeed there are times when deflation can be a symptom of encouraging underlying developments. It can, for example, be brought about when advancing productivity enables the economy to produce more goods and services at lower cost, raising consumers’ real incomes. There were several such periods of “good deflation” while the world was on the gold standard; with growth in the money supply constrained, prices were pushed down whenever the volume of output grew rapidly.Michael Bordo and Andrew Filardo, two economic historians, point to America’s 1880s as a period of “good deflation”, with output rising by 2% to 3% a year from 1873 to 1896. For all the aggregate benefit, though, falling real wages hurt workers in many sectors.

By contrast bad deflation results when demand runs chronically below the economy’s capacity to supply goods and services, leaving an output gap. That prompts firms to cut prices and wages; that weakens demand further. Debt aggravates the cycle: as prices and incomes fall, the real value of debts rise, forcing borrowers to cut spending to pay down their debts, which ends up making matters worse. This pathology did great harm during America’s Great Depression, which was when Irving Fisher, an economist, diagnosed it under the name “debt deflation”. Deflation in Germany at the same time, though eclipsed in the common memory by the damage done by the hyperinflation of the 1920s, caused a number of multiple bank collapses. The resulting unemployment, wage cuts, and credit crunch helped radicalise workers and fed support for the Nazis.

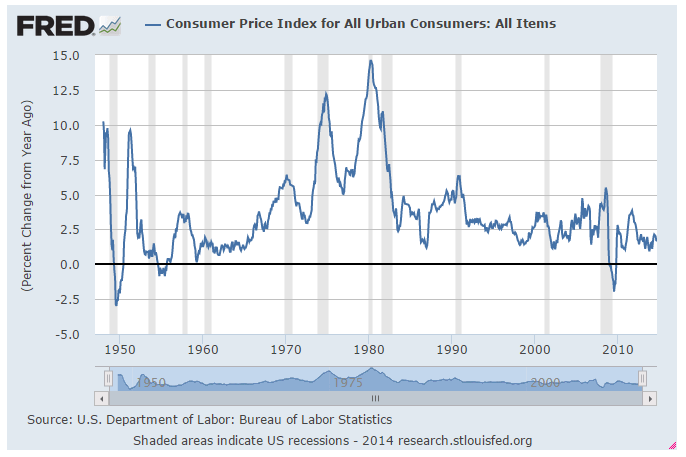

Which of those situations better describes what’s happening in the eurozone right now? And when US prices were falling in 2009, was that due to technological innovation or a collapsing economy? I’ll be honest, the distinction seems pretty obvious. Yet too often — at least on the right — deflation is treated as if it were always and everywhere a good thing. But how do policymakers figure out whether deflation is good or bad? Scott Sumner frames it this way: “In my view deflation is neither good nor bad, just irrelevant. On the other hand falling NGDP matters a great deal, and should be avoided.” So have the Fed — preferably through a market-driven tool like a NGDP futures market – target the the level of total spending in the economy at 4-5% a year. Supply-side factors would determine what share nominal GDP growth is real GDP.

Published in General

“falling real wages hurt workers in many sectors.”

This is what happens in an inflationary environment, not a deflationary environment. If it had said nominal wages that would be correct.

Deflation is not always good, just like inflation isn’t always bad. The deflation we are experiencing right now is due to the ECB, China, and Japan finally starting their own QE while the Fed is tapering down ours. Plus, the Russia and the Middle East are pumping oil like crazy because Russia needs to revenue to keep their budget balanced in the face of US sanctions, and the Middle East is trying to bank a bunch of cash because they are afraid ISIS is going to take over their oil fields. I just wish the drop in oil prices had occurred in the summer as it would have lowered the cost of fuel for my fishing trips :)

In the nominal GDP picture, is the Real GDP growth rate essentially capped? Because it seems to be looking for 3% real growth and 2% inflation. I guess we could see 6% real growth and 1% deflation, but I don’t care for it’s implicit assumption that 3% growth is good and sustainable where two much it unhealthy. If the government were to butt out, I feel we could expect much higher sustained growth a mere 3%.

So, we need to fight deflation with low interest rates because low interest rates incentivized people into taking on too much debt?

The first paragraph of the “Economist” excerpt has it right. Falling prices due to improved productivity are a good thing.

They miss the mark in the second paragraph. Falling prices due to slackening demand, may be the result of a bad thing (a weakening economy) but are a good thing in and of themselves. That is, they are the economy’s way of correcting itself through the price mechanism. Government efforts designed to prevent the fall of prices when demand is slackening are harmful. They block the economy from correcting itself and commencing on a substantive recovery. Quantitative Easing (QE) is an example of that.

Some people say that QE is coming to an end because the economy is beginning to recover. They have the cause and effect backwards.

Bad deflation and bad inflation are both the result of changes in the value of currency.

James, my perception of these debates isn’t so much that they’re about whether deflation is always good or always bad. Rather it’s whether preferred policy is in accord with reality or is a refusal to recognize reality. You’re correct that both inflation and deflation can be “good” or “bad” depending on circumstances and on whose perspective we’re considering. As such we need to first establish what is reality; to the extent that we can arrive at anything close to reality concerning something like the global or even national economy, policy should be set to remove encumbrances to good decisions while minimizing distortions which make bad decision making artificially attractive.

I’m skeptical that we’re able to know enough to be able to set real targets that are timely and then achievable. Even smart people will make mistakes. To me, scenario #2 is easily the flipside of scenario #1. Perhaps sudden gains in productivity and innovative achievements make overvaluation and misallocation of assets more likely. Whatever the case, I’m at least partial to the idea that these mistakes and gains can’t be policied away or policied into perpetuity. Real effects of economic activity will wind and unwind themselves no matter what; the question is whether policy is set to remove distortions or whether it’s the cause of distortions.

That’s what I meant to say in many less words. :)

When things get cheaper because we have better ways of producing them, it is a huge win. Energy ties into everything, and falling energy prices makes everything else less expensive to produce. That is all very, very good.

Right, deflation is bad because banks made loans based on inflated prices in the midst of the credit boom bust cycle.

I thought the fed was supposed to fix this, why do we keep having them?

Deflation is way worse.

And it is so predictable. First the government raises taxes and fees. Then the insurance companies raise all of their fees and premiums. Like clockwork, people respond by buying fewer consumer goods.

This is a consumer-based economy.

It doesn’t take a genius to see what happens next.

What you are calling “deflation”, most people think of as “I get more from my dollar”. I contend that this is a very good thing. I realize that when the government is running deficits and financing ever increasing debt, they feel deflation is a net benefit for them since they can pay it back in nominal “less valuable” dollars.

For real people, if the dollars I earn permit me to purchase more of the goods and services that matter to me, this is a good thing. This is true whether it is on the international or local stage.

Seems like there is a lot of mixing up of deflation and inflation today. Inflation is a boon to debtors and a bane of savers, not the other way around. Governments with lots of debt that operate on a fiat currency want inflation not deflation. Deflation makes your dollars more valuable, inflation makes your dollars less valuable. Since debt is usually denominated in nominal terms (i.e. dollars), if you get hyperinflation (i.e. a gallon of milk now costs 1 million dollars) debts are easy to discharge.

When you own a home, especially with a mortgage, deflation is a nasty and scary thing. But it is important to differentiate between the kinds of deflation discussed here

1. Deflation due to productivity increases. The price of your iPad went down as the price of your home went up. This kind of deflation has no effect on home prices.

2. Deflation due to a weakening economy. This can lead to home price deflation, but the real cause is the weakening economy. If left alone, it will be short lived and housing prices will recover again. Trouble is, it is never left alone.

3. Bad (monetary) deflation. This is caused by the Fed tightening money too much and increasing the value of the dollar. This will definitely cause home prices to fall, but it is rare because the Fed tends to err in the opposite direction.

4. Asset deflation in the aftermath of an artificially created bubble. This is the cause of most of the recent real estate downturns, and it is nasty. We know all about Fannie Mae and Freddie Mac, “liar’s loans” etc. All of this was exacerbated by a major devaluation of the dollar, which made it look like home price increases would never end. All it took was a slight increase in interest rates and it all came crashing down. People who bought during this time found themselves upside down in their mortgages. This kind of deflation is caused by the preceding inflation, and is the worst of all.

I’ve thought a while now that the Progressives overlords now in power would somehow find a way to produce both inflation and deflation at the same time…

In a way, they did.

From 2001 to 2012 we had very high monetary inflation. The price of gold and other non-agricultural commodities increased at a rapid rate, almost in unison. We all know what happened at the gas pump.

At the same time, the Consumer Price Index (CPI) didn’t increase at nearly the same rate. So, what was up with the CPI?

CPI calculations are a mystery, even to its staunchest defenders. I offer this half-baked (and probably wrong) theory:

The high monetary inflation was partially cancelled out by demand related deflation. If the fed had not done its Quantitative Easing (QE), the prices of many things would have gone down. This deflation would not have been the monetary or “bad” deflation, but the market’s price mechanism at work. QE was a misguided, but successful, attempt to keep those prices from falling.

If those prices had been allowed to fall, the recovery would have begun a lot sooner.

The piper has not been paid yet. Without hyperinflation, this country cannot deal with its massive, massive liabilities (estimated as high as $100 trillion counting pensions).

The CPI is notorious for being a small snapshot into the price world, and can be impacted by price changes within its basket of goods that are not necessarily related to monetary policy. The Fed has really, really big levers, but the market is filled with millions of tiny individuals and corporations, all acting in their own self-interest. To me it’s a lot like trying to pick up a pile of cooked noodles with a bowling ball – whatever the Fed does is likely to have unforeseen impacts and the general result is a mush.

Asset inflation has done about zero to improve median household incomes, which was one of the advertised bonuses of ZIRP. Turns out that making money cheap to borrow and paying banks to hold assets that return interest at the Fed doesn’t necessarily mean that individuals are going to buy a house, car, or condo. In fact, the two are not correlated at all, as median household income has stagnated as the Fed’s balance sheet has gone through the roof, and the stock market has inflated.

Very little of all of this has had much to do with the concrete world of buying and selling actual tangible, real-world goods, which is what CPI, etc., base their calculations on. Deflation is a factor now because incomes have stagnated. When there’s less demand, prices drop. It doesn’t need to be more complex than than, but I agree that there can be a snowballing effect that as demand drops, wages will drop further as there’s less demand for labor to build products or provide services that no one wants to buy.

Your chart uses CPI as an indicator of inflation/deflation. CPI, like unemployment, is a political number that can, and is manipulated. It is very important to the government to keep CPI low since it automatically controls much of the governments entitlement spending.

How is it manipulated? By changing the basket of goods tracked to calculate CPI. Next year they are going to chained CPI, which means if the cost of a good goes up (steak), and there is a substitute (hamburger), than the substitute will replace the original good in the CPI calculation. POOF, no inflation!

Currently, the CPI basket is heavily weighted with oil, electronics and housing. The things people actually buy most of, food, electricity, water, sewer, health insurance, taxes, are all increasing rapidly, and kept to a minimum in the basket. Gasoline is down, but most things the average consumer buys are going up. Anyone who handles their own finances has to know this.

By my calculations, if we used the basket of goods that I buy to calculate CPI, inflation would be running close to 10%. I’m not too worried about deflation.

“…bad deflation results when demand runs chronically below the economy’s capacity to supply goods and services, leaving an output gap.”

What is supposed to happen is that the least effecient firms go bust. This closes the output gap and frees up resources and market space for some new venture. To steal a phrase from Nasim Taleb : that’s why NYC has such great food – bad restaurants don’t last long.

But the Keynesians cannot abide this natural turnover in the economy. Every downturn, the Keynesian believes, must be aggressively fought with every monetary and fiscal tool available. The result being that inefficient business are proped up and resources that should go to new ventures are squandered keeping ‘bad restaurants’ open.

Recessions and periods of ‘bad deflation’ should serve the same function as fire does in a healthy forest. It culls the sick trees and removes strangling undergrowth, making room for fresh new growth. And as we are learning in forestry, over reacting to minor fires chokes the existing forest and creates the conditions for a major conflagration.