Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

The Reality Behind the Student Debt “Crisis”

The Reality Behind the Student Debt “Crisis”

Lost amid all the political news this week is a new White House report on student debt in higher education. One thing I was curious to see was what conclusions it drew about the macroeconomic impact of high debt levels. Politicians, especially presidential candidates, sure seem to think it’s a pretty big problem. From the report comes a different view:

Lost amid all the political news this week is a new White House report on student debt in higher education. One thing I was curious to see was what conclusions it drew about the macroeconomic impact of high debt levels. Politicians, especially presidential candidates, sure seem to think it’s a pretty big problem. From the report comes a different view:

The rise in student loan debt has created challenges for some borrowers with lower earnings, but has not been a major factor in the macroeconomy.

— Despite its steady rise over the past decade, aggregate student loan debt remains small relative to aggregate income. In 2015, total student loan debt was 9 percent of aggregate income, up from 3 percent in 2003. By itself this is considerably smaller than the rise in mortgage debt prior to the crisis and it has also been accompanied by a reduction in other forms of consumer debt.

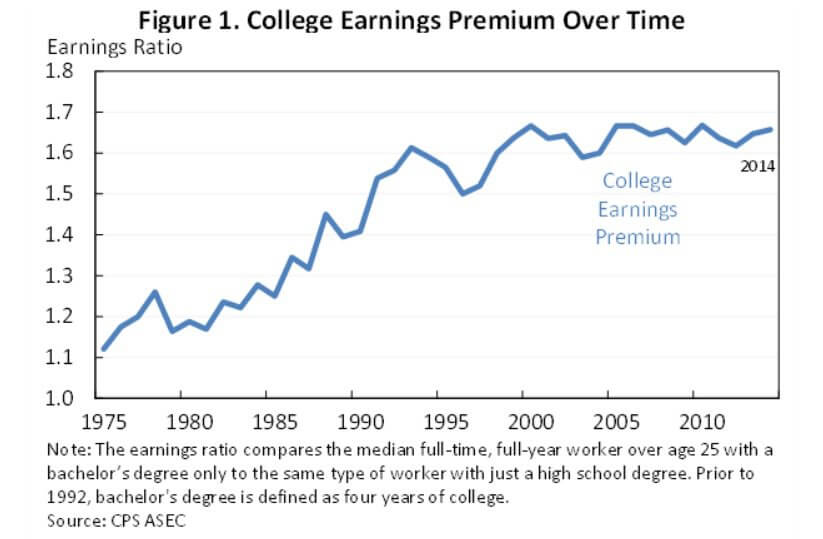

— Additional student debt, as an investment in education, is associated with additional income, putting many households in a better position to buy homes or start businesses. By age 26, households with student debt are more likely to buy a house than those that did not attend college. By age 34, college attendees with and without student debt are equally likely to buy a home, and both much more likely than those without a college education. Research studies have found that conditional on a given education, higher student debt explains, at most, a small fraction of the decline in homeownership among younger households.

— At the same time, the increase in defaults on student loans as well as the increase in high loan balances for low earners can be real concerns at the individual level, potentially leading to compromised credit and reduced home buying for some individuals.

A few brief thoughts from AEI’s education scholars. First, Jason Delisle:

The report is important for dispelling a dangerous myth that we see a lot, which is that student loans hold back the economy. We’ve heard that this time and time again from advocacy groups complaining about rising levels of student debt. They say student debt is forcing people to delay things like buying a house, starting a family, all productive things. This report is pretty clear that isn’t the case…

One point I think many will miss but is very important: the administration is trumpeting the millions of student loan borrowers who have taken advantage of the Obama administration’s income-based repayment for student loans. OK, that’s an accomplishment. But then another theme of the report is that the economic returns for students who pursue a higher education are quite large. Indeed. So here is the question I have: Why are millions of borrowers flocking to enroll in a program that allows them to cap their student loan payments at a small share of their income if the return on an educational investment are large? Something seems amiss there. I’ve done a lot of work showing that the income-based repayment program is too generous as a result of Obama administration changes, which may explain this disconnect.

And Andrew Kelly:

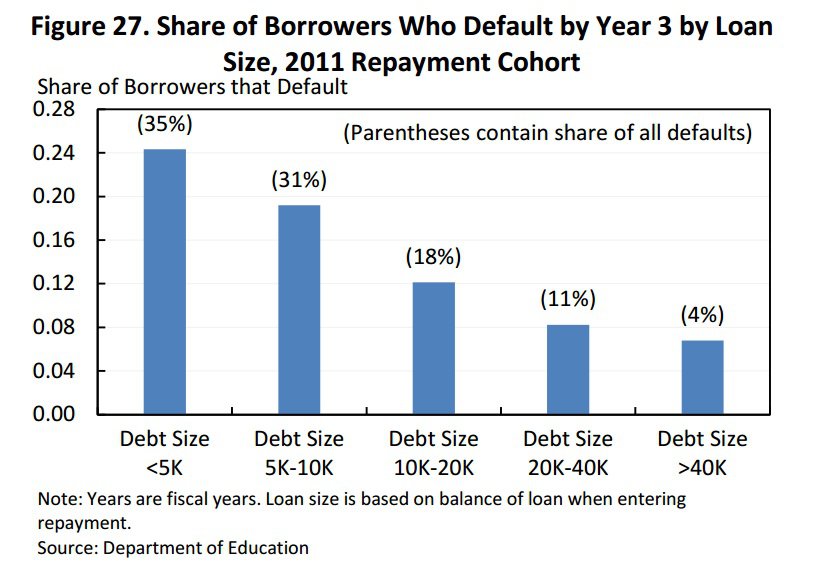

The solutions trotted out by Dems this cycle — refinancing of student loans, lower interest rates on new loans, a three month moratorium — are designed to help solve the problem that advocates have identified as the crisis (the stock of student debt). But this report (and others) makes clear that the real repayment problems seem to be among students who drop out and have small balances (often $5,000 or less).

Lower interest rates won’t help folks with small balances who aren’t repaying nearly as much as they’ll help those with average or large balances, most of whom have no trouble repaying because they have the highest educational attainment!

And a chart illustrating Kelly’s point:

I wish there were a way to put some of this responsibility back on the schools making the loans. I know some grads of major universities with huge endowments who extracted money from students for masters’ degrees–a cash cow for them–that haven’t worked out well, yet they have endowments that they got by telling wealthy alums they would use the money for student aid. Then the money doesn’t go to students. Universities in general need to bear some responsibility in this because they give loans for degrees that won’t give the student earning power, get money from alums that doesn’t go to students, jack up tuition and pay no price.

I strongly suggest you redo all this work incorporating degree FIELD as an independent variable. Contrary to the beliefs of Democrats and other extreme Leftists, a degree in Womyn’s Studies is not in any rational way the equivalent of, say, a degree in Mechanical Engineering. I strongly suspect a competent researcher* would find a strong causal relationship between academic major and ability to repay, and that the debt crisis is very real and only appears when that is taken into account.

Until these “research” efforts take field of study into account, they are junk.

*I’m being polite.

I couldn’t agree more…not all degrees are created equal. For starters, any degree ending in the word “studies” should be automatically disqualified for any type of government (state or federal) subsidization and student loans.

Yes, this scam has been a ruse by universities to get the cash into their pockets, at the same time as they dun alums to pad the >$1 B endowment.

It is true that state legislatures have reduced levels of public support, but it is easy to see why. Tax-paying constituents are tired of being called racists by university-paid “diversity consultants”.

When my alma mater gets rid of all of its diversity infrastructure, the social science baloney, and starts to even up their current research efforts on green stuff so that all sides are fairly represented, I will kick in and donate myself. But I won’t support the current mess.

I have a nephew who will graduate after 9 semesters, a little behind schedule. It’s a business degree and it sounds like he won’t work in that field. He was a varsity swimmer (NCAA DII) and is interested in coaching. That’s not a lucrative field, especially starting out.

His parents ensured that he wouldn’t get into crushing debt by going to a mid-tier public school, and of course he had a partial athletic scholarship.

There are other paths to minimizing expenses, including community college for your first 2 years.

Anyway, he’s in good shape, and whatever money worries he might have, college debt won’t be one of them.

In Alaska, funding for the university system here is being drastically cut because of an overall state funding crisis. I’m not sure how aware the general public is of the campus environment, and there’s no indication I’m seeing that the funding cuts are because of the politically correct environment, as well as soaring administrative costs that the university suffers.

I am very aware of the wasteful spending on those campuses because I worked there, though it’s been 19 years since I have (hard to believe). But the general public has only a mild perception of the problem, and there’s no outcry to punish the university because of it. It’s mostly apathy.

Student debt and it’s impact are symptoms of the overall problem of Federal involvement in University (or any level) education. Of course, none of the data mean anything as they are averages with the important variables averaged out. E.G. which majors are consumer goods with negative or no return and which are investments with a positive return and, within those general fields, what other variables make a difference. For instance, a liberal arts degree can be an empty waste of time learning some current fad, or it can be a deep dive into the great literature, history, philosophy. Such differences aren’t just a matter of economic return and the differences to different people aren’t knowable in the aggregate. People can sort it all out, remote bureaucrats can’t. This is like saying aggregate investment is up so any investment is good. (Well, the same macro economists who address these statistic make such claims) The Feds should not be in education at any level.

Isn’t a big source of the problem the amount of money made available to students by the government? As the pot grows larger and larger, the more universities can charge. And a large portion goes to fancy dorms – with amenities those of us who graduated years earlier could have only dreamed of, new buildings of questionable educational benefit, etc. And then there’s the “Studies” programs which could be said to be used to generate grads who will ensure the monies keep rolling in. More victims, more money.

And the size of university administrations brought about by gov’t intervention into all things large and small. (See above for just one example.) What a racket.

We understand this – together with the realities of which Mr Pethokoukis wrote (great piece), but the message continues to be overshadowed by the Dems cry for free education for all. Sounds good, but doesn’t track with reality. How ’bout a graduation requirement for a non-Keynesian course in economics? I know, I know – fat chance… (Maybe just a requirement for a few hours of YouTube – Milton Friedman!!)

I’d like to see an interest-rate surcharge for those graduates who join the ruling class and go to work for the government. Maybe an extra 3.5 percent per year.

Unfortunately, Congress doesn’t have any say in the matter.