Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

Coming Up Next on That 70s Show: Stagflation?

Coming Up Next on That 70s Show: Stagflation?

Last week, the European Central Bank lowered interest rates — to negative 0.1%. “What,” you may ask, “is a negative interest rate?”

Last week, the European Central Bank lowered interest rates — to negative 0.1%. “What,” you may ask, “is a negative interest rate?”

As the New York Times explained before the move,

When a bank pays a 1 percent interest rate, it’s clear what happens: If you deposit your money at the bank, it will pay you a penny each year for every dollar you deposited. When the interest rate is negative, the money goes the other direction.

We’re talking about central banks here, but the same notion applies. Commercial banks maintain their reserves electronically at a central bank, like the Federal Reserve in the United States or an arm of the European Central Bank in Europe. In normal times, they are paid an interest rate set by the central bank for reserves they keep on deposit beyond what is needed to meet regulatory requirements. If the E.C.B. moves to a negative interest rate, they will instead have to pay the central bank to park money there.

The NYT notes that the ECB is not the first central bank to set its benchmark rates negative in recent years. And negative rates also can arise naturally in the market. For example, yields on Swiss government bonds have been negative on maturities of up to three years for some time now. And Swiss banks have been “crediting” negative interest as well.

Negative interest rates arise from two (not necessarily exclusive) economic phenomena. The first is the link between risk and reward. Investors require a higher return for greater risk and, conversely, will accept a lower return for less risk. Putting your money in the bank is one of the safest investments. When the bank’s own returns on its investments are particularly low, you may need to actually pay for the improved security that a bank offers relative to a mattress.

The second economic phenomenon is inflation (or deflation, as the case may be). To this point, I have described what are called nominal interest rates — the promised amount in a given currency. But the purchasing power of that earned interest is not guaranteed. When you adjust nominal rates for inflation, you get real interest rates. And in our post-2008 world, real interest rates are often negative. CPI inflation over the last 12 months was 2.0%. If you are earning 0.25% nominal interest in your savings account, that is equivalent to a -1.75% real rate. Typically, a negative nominal interest rate is used to fight deflationary conditions (represented by a negative inflation figure).

Inflation is where the analysis gets tricky. Inflation may be easy to define theoretically, and plug into the formulas you find in your macroeconomics textbook. In messy reality, though, an overall level of “inflation” is much harder to define and measure. CPI inflation is calculated by surveying and averaging prices on a fixed basket of goods. In recent years the prices for durable goods (appliances, electronics, clothing) have stayed constant or fallen. Meanwhile, the prices for consumables (food, energy) have risen sharply. As a result, reported overall inflation has been tame. But none of us will consume precisely the basket contained in the CPI. And the CPI itself tries to control for improving quality, which tends to drive prices up in practice. That’s why most of us will see rising prices on everyday items, then find larger purchases — which have improved features from last year — cost about the same or a little more.

In the US, the Federal Reserve has taken a different approach from that of the ECB. The Fed has kept its benchmark Fed Funds rate effectively at zero, but has engaged in “quantitative easing”, or QE, as a substitute for negative rates. I won’t go into detail here on what QE is, except to say that it fights deflation by directly injecting cash into the economy. Ordinarily, a central bank would expand the money supply by lowering interest rates so as to induce commercial banks to lend more. Note that the ECB has tight formal restrictions that prevent it from doing QE — though the ECB is working hard to have them relaxed.

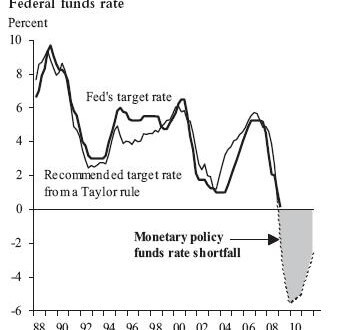

What’s interesting is where rates would be if, in theory, the Fed decided to “go negative”. One way to determine this is by applying the “Taylor rule”, named for its 1973 inventor, Stanford economist John B. Taylor. (Taylor has been cited as potential Fed Chairman material if we ever elect a Republican president again.) His rule, which has spawned many variations, attempts to provide the policy interest rate level required to keep output and inflation stable over a long time horizon. As such, it also serves as a forecast for the Fed Funds rate, given changes in unemployment and inflation. Here is a comparison of actual Fed Funds vs. the Taylor rule over time:

According to the forecasting rule, absent QE, rates should have gone as low as -5%, and stayed negative for a considerable amount of time! This suggests why, despite all of the Fed’s money creation, aggregate inflation has remained tame.

Starting last year, however, Taylor’s formula began to once again indicate positive rates. According to Taylor himself, it gives a rate today of about 1.25%. Caveats are in order, particularly the fact that measuring unemployment has become more art than science in the age of Obama. But the trend is clear: To keep the balance of output and inflation, the Fed will soon need to raise rates. Otherwise, inflation is liable pick up — and quickly. Former Fed Chair Ben Bernanke testified to Congress that he is confident the Fed will detect any incipient signs of inflation and nip it in the bud. He’d better be right.

The Fed has been keeping rates low because economic growth has been anemic. Which brings us to the “stagnation” side of the “stagflation” portmanteau that we first saw in the 1970s. Economic growth during the Obama years has averaged 2.2%, vs. the post-WWII average of about 3.3%. What’s particularly distressing is that economic growth usually roars ahead after a recession — but growth during Obama’s recession has been about half of the 4.1% average for recoveries.

And it could be getting worse. Last quarter, GDP “growth” came in at -1.0%, i.e., economic contraction. The average prediction of economists for our current quarter is about +3.6%, which would be a welcome reversal. But since 2008, results have consistently trailed economists’ predictions. It seems to me that economists have been missing the forest for the trees. In their focus on numbers and modeling, they are missing an intangible cultural shift that also characterized the 1970s: uncertainty. Investments can take a long time to pay off. But every few weeks or months, there is an announcement of a new government initiative or policy. How will individual and corporate tax policy change in the interim? Environmental regulations? Wage and benefit mandates? Subsidies to competitors? Tariff and trade barriers? Immigration enforcement through employer sanctions (or lack thereof)? Stability of international trade routes? As in the 1970s, the political risk has risen in just about every economic undertaking, while the returns have not risen commensurately.

So let us hope that the economists are not, in fact, being too optimistic. Otherwise, foreign policy is not the only area in which we could soon see a rerun of the 1970s.

Published in General

Damn interesting, Spengler, good post. I thought I knew some of this in general, but articulation is ammo–it makes all the difference.

“Anyway, we delivered the bomb.” Quint’s conclusion to his terrifying description of the aftermath of the sinking of the USS Indianapolis.

i can’t help but think in the not too distant future, our financial geniuses will be saying the same thing. “Anyway, we re-capitalized the banks.”

I’m growing my hair to 1970’s levels to celebrate.

As the saying goes, “There are many ways to skin a cat”. It’s wealth taxation any way you cut it.

And I think inflation has been drastically understated. Food prices have skyrocketed under Obama. It just so happens that every area where prices inflate the most are removed from the reported rate of inflation.

I think part of our problem is that too many of us — and our political leadership — confine their economic thinking to money and banking. They give too much credit, and too much blame, to the “financial geniuses”.

Obamacare has huge implications for economic growth — and it’s not a matter the financial wizards had anything to do with. The year-to-year continuing resolutions and debt standoffs, and unpredictable tax policy, have implications for economic growth — and the financial wizards have nothing to do with them. The EPA’s power grabs on carbon and coal have implications for economic growth — and the financial wizards are not anywhere in sight. And when you put it all together, the unpredictability of regulation, enforcement, policy, and prosecutorial choice combine to make the entire economy more risk-averse. Since lower risk means less innovation, our lives will all be poorer than they could have been.

Be careful in your interpretation. CPI is reported both in aggregate, AND “excluding food and energy”. The latter is reported because volatile food and energy prices can mask fundamental trends. The media focus on this number But the overall CPI — which includes food and energy, and is used for COLA and other official purposes — does, in fact, get calculated and reported as well.

Thank-you so much for explaining this, S.o.S. I read part of this to my elder daughter last night; she had never heard of negative interest rates before, and she was really surprised. I thought I knew about them, but I see from what you wrote that I’d misunderstood them before now. Very well explained.