Ricochet is the best place on the internet to discuss the issues of the day, either through commenting on posts or writing your own for our active and dynamic community in a fully moderated environment. In addition, the Ricochet Audio Network offers over 50 original podcasts with new episodes released every day.

Does America Want Sharply Higher Taxes on the Rich?

Does America Want Sharply Higher Taxes on the Rich?

Where are top income tax rates heading? The answer may depend on how Americans view the rich and the reasons behind high-end income inequality. Are the 1% and 0.1% and 0.01% pretty much deserving or undeserving?

Or to put it another way: If you believe — mostly — that macro forces such as technology and globalization have boosted top incomes by allowing highly talented and educated individuals to manage or perform on a larger scale, then you might be less inclined to support higher top marginal rates. But if you believe the “rich getting much richer” phenomenon is mostly driven by compliant corporate boards overpaying CEOs and a breakdown of social norms against exorbitant pay, then you might favor sharply higher tax rates.

So where are we today? In a new Harvard Business Review essay, Roger Martin argues that American attitudes toward taxation and the rich have moved through four historic eras. From 1932 though 1981, for instance, top tax rates rose from 25% to a high of 94%. During that period, high incomes were thought to be something obtained by owning assets rather than through work. Martin: “According to the theory, most rich people were basically rentiers and their income from owned assets could — and should — be taxed at very high rates with no adverse impact on their behavior or the economy.”

Since then, a different economic theory and attitude has held sway, resulting in much lower top tax rates (even with the Obama tax hikes.) Recognizing that the US had become a knowledge-driven economy, “lawmakers finally abandoned the prewar assumption that all rich people were rentiers and recognized that at the prevailing rates talented people were being put off work.” So taxer were lowered to encourage more work.

So will the current era continue? Martin doubts it:

In times of crisis, America has shown that it asks the super-rich to pay a lot more than the rich and I think this will happen based on the feeling that it is a time of economic crisis in America. Also, although applying a rich-as-rentier theory (implying tax rates in the 70% plus range for high incomes) isn’t really fit for purpose in a talent-driven economy, it’s also not justifiable to have a maximum rate that doesn’t distinguish between a mid-level executive and a hedge fund manager.

My bet is that the Fifth Era will look a lot like the early Third Era — after the height of the Great Depression but before the inception of WWII. That is, $10 million earners paying in the 75% range, $1 million earners in the 50% range and $500,000 earners in the 35% range.

How high or low the rates of the Fifth Era structure will be will depend, I think, on whether talent is seen as engaging primarily in trading value or primarily in creating value for their fellow citizens (in terms of better products and services and more jobs). If it is the former, they will be taxed more highly as unworthy rentiers and there will be little concern for incentive effects. If the latter, they will be taxed as important economic assets whose incentives must not be dampened. Right now, sentiment is trending more in the former direction than in the latter — a perception that the talented people on the Forbes 400 list have done little to dispel.

I will admit that given the financial crisis, Occupy Wall Street, and the incessant media coverage of the income inequality issue, Martin’s conclusion may intuitively feel right. Then again, national Democrats aren’t running on raising top tax rates further. Nor would I expect Hillary Clinton to do so in 2016. I doubt left-liberal pols think America is ready to embrace pre-Reagan tax rates (although left-liberal economists have given them the academic go-ahead.) Left-wingers can’t even do that in France.

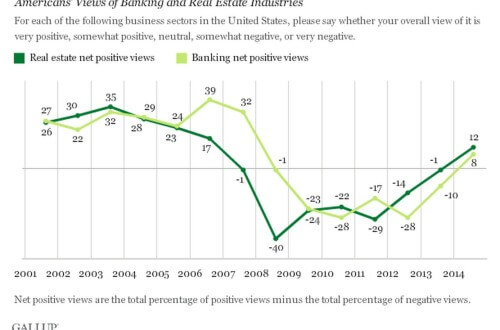

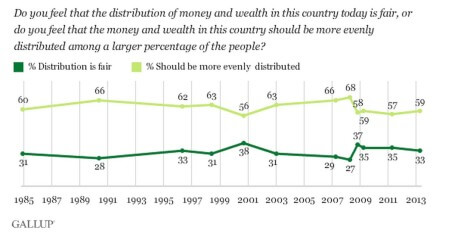

Indeed, polls don’t suggest any unusual urge to sock it to the rich. Take a look at these two Gallup surveys. The first, from earlier this month, shows banks — I would guess that people see rich bankers as less deserving than tech entrepreneurs — with a net positive approval rating. The second, from last year, shows that while Americans favor income redistribution, not any more than they did 30 years ago despite rising high-end inequality:

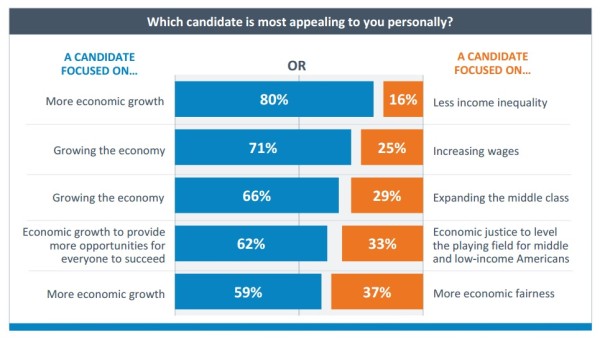

People have mixed feelings about inequality, what’s driving it, and how it’s affecting the economy and their chances for success. I think people buy into the talent-driven explanation yet also think the game might be rigged for some at the top. That is certainly how I view it, given a world of both technological change and Too Big To Fail (plus other cronyist policies). But at this point, growth rather than less inequality seems to be what voters prefer. And while they may not think tax cuts for the rich help growth, they don’t yet think massive new tax hikes will help either (via GlobalStrategyGroup).

As I understand it, in the United States, tax receipts are seldom over a little less than 20% of GDP no matter what the rates are. If you believe that the purpose of taxes is to fund the commitments and choices our government has made shouldn’t the correct tax policy be the one that grows GDP the fastest? Why is income inequality the appropriate focus? Maybe that is the difference between the world view here at Ricochet and the DNC.

The game most certainly is rigged at the top.

It’s called crony capitalism. It’s bankers taking wild risks knowing if they get in trouble they can call up their buddies in Washington for a bailout. It’s agribusiness conglomerates taking huge agricultural subsidies to grow nothing, or to convert corn into ethanol no one really wants. It’s company lobbyists writing regulations that create barriers to entry into their markets from smaller firms. It’s Solyndra (enough said).

I think a big problem for selling the conservative message is that when we defend capitalism and free markets we know, in our own minds, that we are envisioning a pure form of free enterprise with all these abuses stripped out. Unfortunately to many moderates it sounds like we’re just defending the status quo, when everyone knows we’re playing with a stacked deck. And indeed many Republican politicians really are just defending the status quo and wouldn’t dream of, say, cutting agricultural subsidies to their home state.

In my view the primary cause of increased wealth inequality is he increase in the size and influence of government. Who is best able to influence government, to navigate government regulations and complexities and to absorb the costs of compliance? No one should need a study to answer this question. The more government, the less opportunity, the less opportunity, the less economic mobility, the less mobility the greater the inequality. Income taxes discourage thrift, self reliance, and industry and that is true no matter if you call the tax a social security tax, capital gains or income tax. Income taxes are a toy of progressives, it should be clear to anyone reading your post whose game the country has been playing the last hundred years. RR said government is the problem not the solution, seems simple enough to me. It is too bad few current Republicans could honestly say they believe this to be true.

Even when that money is earned through creative endeavour, such as filmmaking, music, and/or software design?

Don’t tax you

Don’t tax me

Tax the fellow behind the tree

– Old adage

Once again “hedge fund managers” figure prominently in the leftist diatribe. I have met a lot of very rich (>$100 M net worth) people in my professional career. Almost all of them were entrepreneurs or entertainers of one form or another. Not one of them was a hedge fund manager. In fact, I have only met one hedge fund manager in my life, and he went bankrupt. Why is the left always raising taxes on “hedge fund managers,” and never on Oprah Winfrey or Steve Jobs?

When a Leftist calling for higher taxes on the “rich” can tell me what current tax rates are, then I’ll discuss the issue with them.

I haven’t yet had the pleasure of such a discussion with a Leftist.

Just asking them “what are the current tax rates?” or even just “what’s the highest tax bracket?” pretty much stops the discussion. They don’t want to have to admit explicitly that they don’t know what they’re talking about.

Less government wont mean less taxes, it will just mean better use of taxes. It would also lead to more entrepreneurs and growth.

Raises taxes almost always means increasing the size and scope of government. I like the last graph because it illustrates the proper focus. Taxes should be used for revenue with a focus on not hindering growth, not to enforce some people’s idea of social justice.

If only more of our fellow citizens thought this way.